1 minute 30 seconds

Written by

Liudmilla Gromadzki

How does Dubai rank in the Global Real Estate Bubble Index 2024

Updated: Apr 02, 2025, 11:44 AM

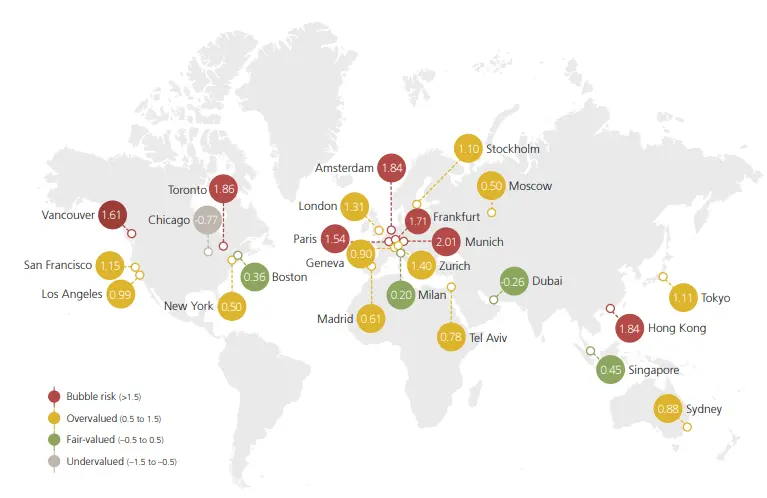

The UBS Global Real Estate Bubble Index 2024 analyzes housing markets in 25 global cities, assessing their bubble risk based on price growth, affordability, and economic conditions. Bubble risk is assessed accordingly: low (score below 0.5), moderate (0.5 to 1.0), elevated (1.0 to 1.5), and high (above 1.5). According to this index, Dubai is ranked on the lower end of the Moderate segment at 0.64.

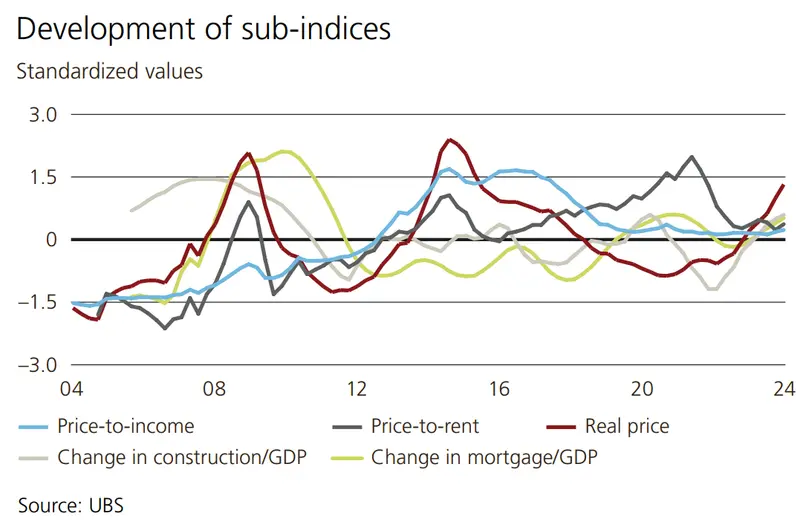

The index is an average of the five city sub-indices.

A price bubble occurs when property prices rise significantly beyond their fundamental value, often fueled by speculation, easy credit, or investor overconfidence. However, a bubble can only be confirmed in hindsight, meaning that it’s impossible to prove a bubble exists until it bursts—i.e., when prices suddenly drop.

Dubai property market trends are promising. The city was the fastest-growing market in 2024, among all cities analyzed, and stands out with the strongest price growth. Dubai’s rental market has dramatically expanded, with rents increasing by 60% in real terms. Despite significant price fluctuations, rental yields remain attractive at 6-7%, further highlighting the potential of Dubai real estate investment.

As a result, when looking at the Dubai Real Estate Bubble Index, we conclude that Dubai bubble risk is moderate.

While Dubai’s affordability remains better than in many Western cities, speculative activity is increasing, particularly in off-plan sales, which could lead to short-term volatility.

Dubai is an outlier, experiencing rapid growth and increasing investor activity, while many global cities are undergoing price corrections or stagnation. Whilst sentiment around investing in Dubai remains positive, it is always best to consult an advisor.

For tailored real estate investment advice please contact: +971 (0) 4 429 7040