1 minutes read

Written by

Vanmarc Montero

Avoid These 5 Common Mistakes When Selling Your Dubai Property

Updated: Sep 26, 2025, 11:48 AM

So, you found a buyer for your property at a good price. Congratulations! That means all your troubles are over, and you should get the cash over the next few days, right? Well, not exactly.

The selling process is not as simple as it may seem on the surface. You may be surprised to learn that handing over your house to a buyer can take up to three months, depending on the circumstances.

In Dubai, real estate agencies use the term ‘conveyancing’ to describe this handover process, which includes documentation, government approvals, and the fees involved in transferring property ownership.

In this article, we'll go over five common mistakes when selling property in Dubai that sellers often make during the conveyancing process and how to avoid selling property in Dubai mistakes.

The 10-year Golden Visa is the most sought-after visa in the UAE, and foreign real estate investors can get one by spending at least AED 2 million on property in the country. Despite the significant benefit property owners receive from obtaining a Golden Visa, there are some Dubai conveyancing mistakes and unexpected complications that can occur when these visa holders sell their UAE property.

These Dubai real estate selling errors and complications occur when property owners forget that selling a Golden Visa-linked property will have an impact on their visa status. Doing so would be a critical oversight. Selling Dubai property legal issues includes selling a property linked to a Golden Visa necessitates the cancellation of that visa because of its direct link to that property, which can surprise an unsuspecting seller and lead to significant inconvenience, related fines, or other challenges.

Furthermore, if you own multiple UAE properties and aren’t 100% certain which one links to your Golden Visa, you will likely face a one to two day handover process delay. This is because of the extra steps you will need to take to identify a golden visa-linked property and resolve any issues that arises.

Determining which properties are associated with a Golden Visa can be difficult, especially for those who own multiple properties in Dubai. The first step is to check with the Dubai Land Department (DLD) if your property is “blocked” for sale, as this may signify a Golden Visa link.

However, checking the DLD alone cannot provide certainty. This is because while the DLD will show if a property is blocked for sale, they will not specify the reason. A “blocked” status can indicate unpaid service charges, an ongoing legal case, or a Golden Visa link. As a second steps, sellers must directly inquire with the visa authorities in Dubai to identify which property is associated with the Golden Visa. Conveyancers at your brokerage can assist in this process, but only with the visa holder's authorization through a Power of Attorney (POA). Once identified, the seller has the option to either transfer the Golden Visa to another property they own or cancel it.

So, if you are a Golden Visa holder looking to sell your property, it is important to alert your broker that you have a Golden Visa from the outset. Then, ensure that they take the necessary precautions and checks to avoid potential complications and delays during your property transaction.

When it comes to property transfers in Dubai, there are three important entities. These are the Dubai Land Department, trustee offices, and banks. The duties and office timings of these entities are as follows:

The Dubai Land Department (DLD)

The Dubai Land Department is the central governmental authority overseeing all real estate transactions and regulations in Dubai. It is the final authority on all property-related approvals, determining the legality and validity of real estate transactions.

Trustee Offices

Trustee Offices are officially designated by the DLD to serve as crucial intermediaries in property transactions. They act as authorized representatives of the DLD, streamlining the submissions process and ensuring compliance with regulations. Their function is administrative only. They do not oversee governance, nor do they make final decisions on property transfer approvals.

Banks

In Dubai conveyancing banks play a crucial role, particularly in financed property transactions. They are not merely document providers, but integral to the legal and financial process. Their involvement includes mortgage registration, no objection certificates (NOCs), loan disbursement, and more.

A common oversight when selling property in Dubai is failing to account for the varied operating hours of trustee offices, the Dubai Land Department (DLD), and, in some cases, the banks. These differences in operating hours can create property selling issues in Dubai and increase potential challenges for sellers, particularly when time-sensitive transactions are involved.

A seller, Ahmed, needs DLD approval for a property transfer. He plans to submit all documents to the Trustee Office on a Thursday afternoon, assuming the Trustee's extended hours will accommodate him. He knows he needs a Mortgage Redemption Letter from his bank to clear his existing mortgage.

Because of the delay, Ahmed's property transfer is pushed back, potentially affecting travel plans or financial commitments. Furthermore, if the buyer has a time-sensitive loan approval or other deadline, the delay could him or her to withdraw from the purchase. This is a significant risk for Ahmed.

If Ahmed had known about the bank's processing time and the DLD's limited Friday hours, he could have initiated the bank request earlier in the week. The fact that the trustee office is open weekends, does not mean the DLD is. This is a common point of confusion.

As a general rule, to avoid mistakes in Dubai property sales, sellers should submit conveyancing documents as early as possible. Ideally, between Monday to Wednesday to account for unexpected delays. Submitting documents on Thursday or Friday can put you at risk of weekend delays.

So, when working with different entities, keep in mind the difference in operating hours to ensure a smooth property transaction process.

In Dubai real estate transactions, you may encounter either a Memorandum of Understanding (MOU) or a Contract F. There are a few key differences between the two and reasons why using a Contract F is more advisable.

Using an MOU will not derail your sale by any means but it will add extra steps to your conveyancing because most key entities will ask for you to draft a Contract F. So, to ensure a smoother process, it’s advisable to use a Contract F from the start.

Service charges are a component of the buyer-seller financial settlement and relate to property service charges. A service charge often covers things like building common area maintenance, payments, and salaries. It is a separate cost from conveyancing and agency fees.

Sellers commonly pay service charges in advance, either quarterly or annually, when a property is sold. Therefore, if a seller has paid for a period that exceeds the property's transfer date, he is entitled to a refund for the unused portion.

Because sellers often misunderstand how service charge refunds work, they frequently expect to receive the entire fee back after a property is transferred to a buyer. In reality, the seller will only receive a prorated refund based on the number of unused days left in the contract period when the property is handed over to the buyer.

For example, Saqib is selling his property and has paid a quarterly service charge in advance (90 days).

This refund is usually resolved directly between the buyer and seller, rather than through a government organization or agency.

Going into a sale knowing how these refunds work will prepare you for the financial reality of service charges, and may save you an unpleasant surprise at handover.

One of the perks of living in Dubai, a global travel hub, is easy access to some of the best travel destinations in the world via international carriers such as Emirates and Etihad. And Dubai residents are known to regularly make use of this benefit.

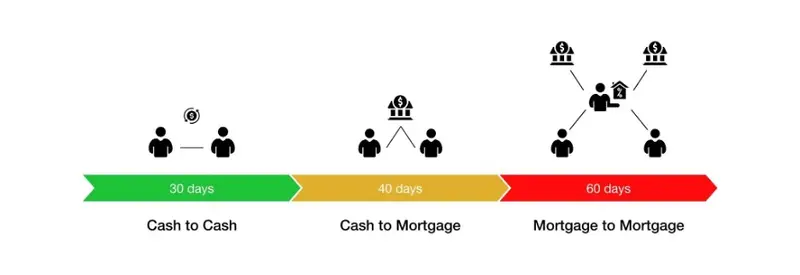

As a seller, don’t overlook the importance of being physically present during the closing process, especially for “cash to cash” transactions, which have exceptionally tight timelines. Ignoring this may put the final sale of your property in jeopardy. Let’s look at the three payment types in real estate sales that impact the timeline.

Real estate transactions can generally be categorized into three main types, each with its own associated timeframe.

Some time frames are calculated in calendar days (including weekends), while others are calculated in business days (excluding weekends and holidays). Miscommunication regarding these differing timeframes can lead to delays and frustration.

The transaction types are as follows:

As a seller, you must be physically present during the final approval process for all types of transactions, whether cash or mortgaged. This is to make sure that all legal obligations are fulfilled and, above all, that you are personally collecting the check that is owed to you. This final approval process can range from as short as 15 minutes to 2-3 hours at a government trustee office.

Alternatively, you may arrange for someone else to collect the payments on your behalf. One method is having a third-party present your Emirates ID and a copy of the buyer's check that has been forwarded to the DLD with your signature on it. Another method is through a Power of Attorney (POA).

Buyers, on the other hand, are only required to be present for a short period of time. They usually only need to spend 15 to 60 minutes to sign paperwork and pay costs. Following that, buyers are free to depart as they will receive their title deed via email.

If you decide to travel and wish to make sure to avoid real estate transaction mistakes, make certain to alert your agent and conveyancing team, and be sure to be physically present for the final approval process. Doing so will help your real estate team build a closing timeline around your plans (and that of the buyer), so that the handover goes smoothly.

The top brokerages have not only expert agents, but also expert conveyance teams. Since a conveyance team’s job is to successfully navigate around the Dubai property sale pitfalls above--bringing the sale of a property to a happy close--it’s important to enlist the right real estate brokerage or agency.

Here are some questions to ask when researching which conveyancing team or agency to use.

1. Does the conveyancing team or agency have a valid license to operate in Dubai?

First and foremost, ensure the conveyancing team is licensed to operate in Dubai. This verification is non-negotiable, whether you’re working with an in-house team from a real estate agency or an independent company.

2. Does the conveyancing fee, if any, match your budget?

Compare conveyancing fees from your selection of teams or agencies. Ensure that their fees match your budget to avoid accruing unexpectedly high fees. This is an important note as the range of conveyancing fees in Dubai can range from as low as AED 2,500 to as high as AED 10,000.

3. What is their reputation?

Look for a conveyancing team or agency with a strong reputation in the industry. Client reviews and word-of-mouth recommendations can provide valuable insights into their performance. Established real estate companies with in-house conveyancing departments often have extensive experience and established processes.

4. How fast is their service?

It’s worth asking your agent how many days it takes the brokerage’s conveyancing team to finalize the process given a set of similar circumstances to those you are likely to face. Often, conveyancing teams from established real estate companies are able to speed up the transaction processes due to the strong connections they have to trustee offices and the DLD. The best conveyancing teams can save you valuable time and reduce potential delays.

On the surface, selling a property seems simple. You list a property for sale with your desired price, meet with a buyer, and then exchange the property for money. However, in reality, it is an extremely intricate process that can last several months, and longer is Dubai home selling mistakes aren’t avoided, with multiple points of contact—buyers, sellers, agents, conveyancers, mortgage brokers, banks, trustees, the DLD, etc.

The good news is these pitfalls can easily be remedied through a little bit of research and employing a competent and experienced conveyancer. So, now, armed with this knowledge, we hope that you are more prepared to sell your property in Dubai...smoothly.

Get your instant Dubai property valuation in just a few minutes from the comfort of home

Get it Now