3 minutes read

Written by

Liudmilla Gromadzki

Abu Dhabi Real Estate in H1 2026: A Beacon Amid Global Volatility

Updated: Aug 01, 2025, 05:56 PM

As we cross the midpoint of 2025, the global macroeconomic environment is increasingly defined by slower nominal growth, elevated interest rates, rising geopolitical complexity and the transition to multipolarity. The reconfiguration of global capital flows and risk premiums means that investment decisions are no longer governed purely by market fundamentals but are increasingly shaped by national security, trade policy, and fiscal sovereignty.

UAE real estate investment insights have shown that amid this repricing, investors are increasingly rotating out of duration-sensitive, low-yielding assets and into real assets with inflation-linked cash flows. Real estate, particularly in transparent, high-growth, and geopolitically insulated jurisdictions, has emerged as a strategic core allocation.

Abu Dhabi, underpinned by prudent monetary policy, FX stability, and a reform-oriented regulatory framework, has emerged as a beneficiary of this capital rotation. While global markets absorb the volatility induced by tariff shocks, rate divergence, and fiscal re-leverage, Abu Dhabi property market in H1 2025 continues to demonstrate a combination of price stability, yield and fiscal defensiveness, supported by sovereign wealth fund buffers and limited external debt exposure.

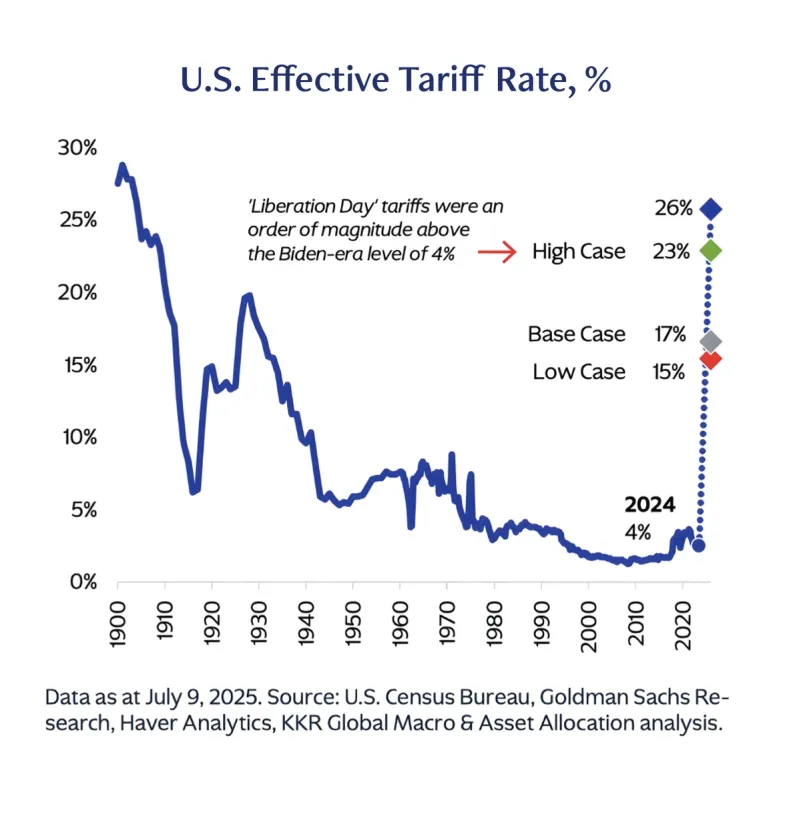

Earlier this year the United States initiated widespread tariffs, impacting over 60 countries and reaching their highest levels since the 1930s. These protectionist measures have introduced stagflationary pressures in many Western economies and increased supply-chain volatility. Many market commentators point to rolling recessions and asynchronous recoveries across sectors and regions following rising tariff tensions.

In contrast to the United States—where fiscal expansion under the “One Big Beautiful Bill” has introduced tax cuts and widened the budget deficit, pushing up the debt-to-GDP ratio and raising queries around the sustainability of sovereign obligation - Abu Dhabi has maintained fiscal discipline, with a debt-to-GDP ratio conservatively positioned at around 14%. As a result we are seeing higher term premiums on US Treasuries, encouraging a pivot toward assets linked to nominal GDP and inflation—namely real estate, infrastructure, and asset-backed finance.

Abu Dhabi’s macroprudence, coupled with a USD-pegged currency and zero capital gains tax reinforce Abu Dhabi’s position as a safe-haven for long-duration capital. This distinction is increasingly relevant in a world where liquidity conditions are being eased via front-loaded US deficit spending and elevated Treasury bill issuance, even while central banks maintain a hawkish posture.

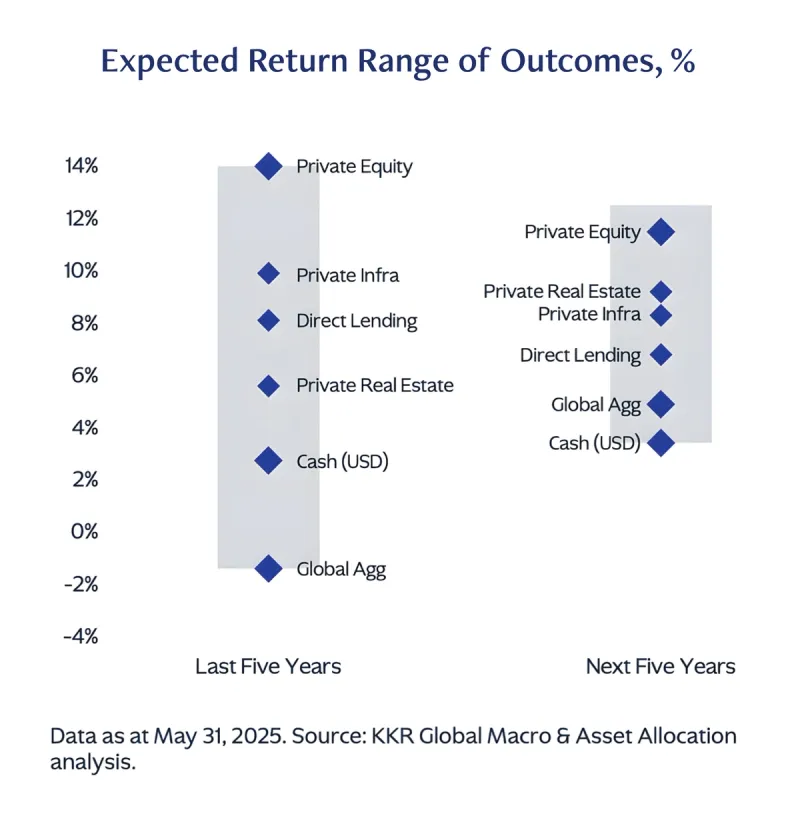

Traditional 60/40 portfolio models are underperforming in today’s macro environment, resultantly alternative assets have moved from the periphery to the core of institutional asset allocation - real assets offer greater control, duration and inflation protection. The next phase of outperformance will come not from market beta, but from complexity arbitrage. Mid-year outlook reports from top tier institutes predict increasing expected returns from private real estate.

The intersection of elevated macro uncertainty, shifting central bank posture, and fiscal asymmetry creates both risk and opportunity. Real estate, particularly in structurally advantaged jurisdictions such as the UAE, offer a compelling hedge against currency devaluation, policy unpredictability, and public market drawdowns.

Key capital allocators are focusing on “collateral-backed cash flows” as core to their allocation philosophy in 2H25—a theme that underpins Driven Properties conviction in long-duration income-producing assets across Dubai and Abu Dhabi’s globally integrated, tax-efficient real estate market.

The Abu Dhabi real estate market report 2025 by Driven Properties reflected strong and broad-based performance in H1 2025, underpinned by robust investor sentiment, sustained infrastructure investment, and regulatory progress in transparency and digitisation. Price appreciation was observed across all segments, affordable, mid-tier, and luxury, driven by both end-user demand and institutional capital seeking yield and downside protection in the current macro environment. Concurrently, Abu Dhabi rental yields in 2025 held firm across key communities, with off-plan absorption rates and transaction volumes signalling confidence in long-term structural growth.

The UAE’s national rail network (already operational for freight) expanded further in H1 2025, progressing toward full Emirates-wide connectivity by 2026. A key MoU was signed between Etihad Rail and the Abu Dhabi Projects & Infrastructure Center (ADPIC) to align rail development with the emirate’s five-year capital-plan, focusing on urban integration, station-based development, and private-sector participation. Once completed, the network will connect all seven emirates, with Abu Dhabi–Dubai travel times estimated at ~57 minutes, and a future high-speed service reducing this time to around 30 minutes.

The digital platform Madhmoun, launched with backing from the Abu Dhabi Real Estate Centre (ADREC), represents a structural leap forward in transactional efficiency and market transparency. Madhmoun addresses previous frictions by digitising and centralising property data on a secure, government-linked blockchain platform, allowing buyers, developers, lenders, and brokers to instantly verify title deeds, ownership history, zoning status, and development approvals, bringing the region closer to international best practices.

Official plans were unveiled by Disney in May 2025 to build its first Middle East theme park on Yas Island, viewed as a global confidence signal. The multiplier effect of this marquee development will be significant across the emirate. For comparison Disneyland Shanghai drew over 11 million visitors in its first year (2016).

Rapid expansion of Abu Dhabi Global Market (ADGM), drawing global asset managers, hedge funds, and alternative capital platforms seeking proximity to the emirate’s $2 trillion sovereign wealth ecosystem and various ministries. Another catalyst for the carving out of ADGM as a financial hub is the limited availability in DIFC, as such there is an overflow to Abu Dhabi. In 2024, ADGM saw a 32% increase in registered firms and a 245% surge in assets under management, with this momentum carrying into 2025 as Q1 licences rose 67%. Major institutions including BlackRock, Morgan Stanley, PGIM, AXA, Marshall Wace, and Harrison Street have all established a presence, well-established Family Offices have also followed suit most notably Bridgewater’s Ray Dalio, this alongside rising inflows from Japan, India and China, further fueling demand for prime commercial space and executive housing.

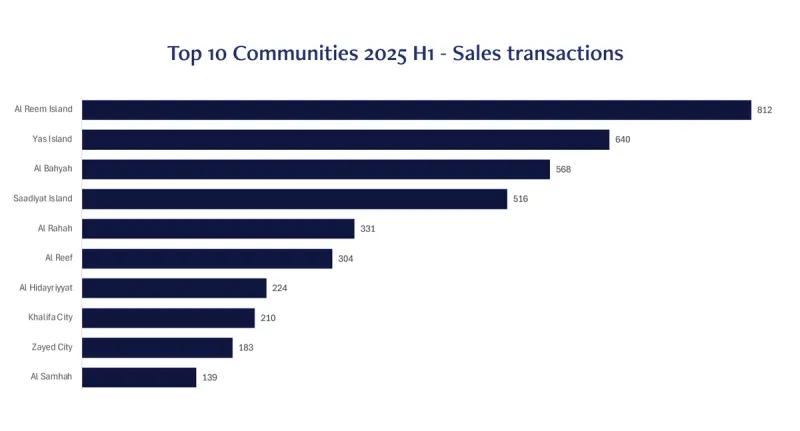

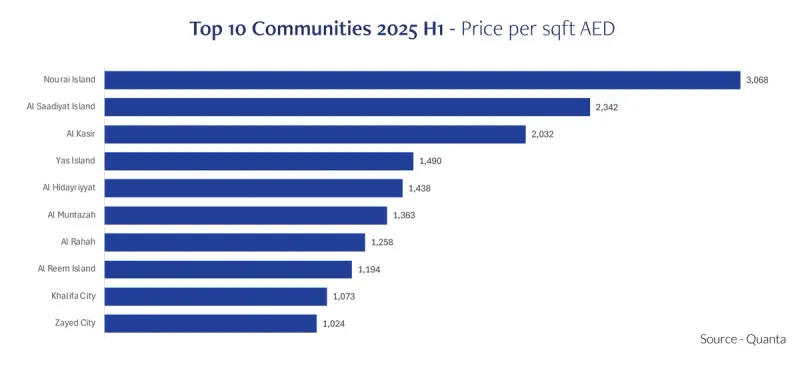

Al Reem Island recorded the highest transaction volume in H1 2025, driven by mid-tier apartment activity. It led the segment with a price per sqft of approximately AED 1,194, up around 10.7% from H2 2024. This robust activity backed by affordability relative to luxury hubs, mature infrastructure, and strong supply from developments like Shams and Reem Hills signals investor preference for communities offering balanced yield and quality of life.

In contrast, areas such as Zayed City and Al Samha recorded notably lower sales volumes. This likely reflects their developmental stage and still-maturing inventory pipelines, rather than weaker fundamentals Nurai Island and Saadiyat Island remain the highest priced residential submarkets in Abu Dhabi, with average price psf reaching AED 3,068 and AED 2,342 per square foot, respectively. This reflects their positioning as ultra-prime, low-density enclaves offering exclusivity, beachfront living, and proximity to cultural landmarks.

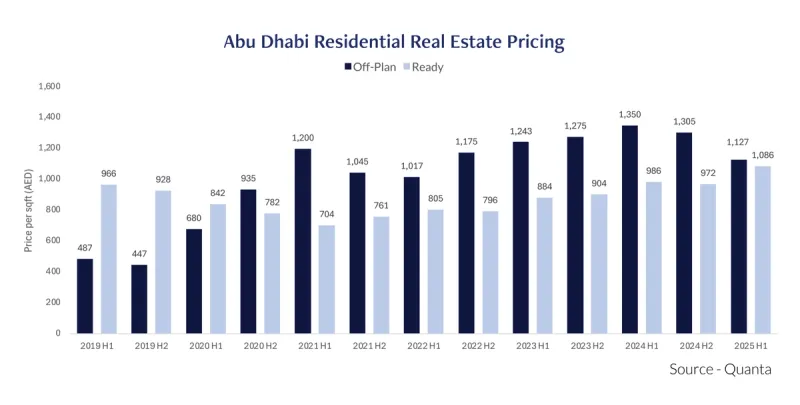

Off-plan residential prices in Abu Dhabi have surged significantly, climbing from AED 487/sqft in 2019 H1 to a high of AED 1,350/sqft in 2024 H1, before easing slightly to AED 1,127/sqft in 2025 H1. This impressive growth was driven by:

However when it comes to Abu Dhabi off-plan market performance, it is important to note that off-plan resale data can be oftentimes misleading in Abu Dhabi. The municipality only records the original launch price of the off-plan property and not the actual resale (secondary) transaction price. For instance, in projects such as The Arthouse, The Source Residences and Louvre, the price per sqft shown in transaction records reflects the original price, even if the unit was resold at a premium in the secondary market as Abu Dhabi Municipality (ADM) fees (2%) are paid only on the original price, not the resale premium. This means:

Looking at Abu Dhabi property price trends, ready property prices started higher (AED 966/sqft in 2019 H1) but dropped during early COVID impacts (bottoming at AED 680 in 2020 H2). Since then, the market has seen measured and sustainable recovery, reaching AED 1,086/sqft in 2025 H1. This reflects:

The narrowing gap between off-plan and ready residential prices—now just AED 41 per sqft in 2025 H1 (AED 1,127 vs. AED 1,086) is a strong indicator of a maturing and more balanced real estate market in Abu Dhabi. This convergence suggests that demand is becoming more evenly distributed across both segments, with buyers increasingly recognizing the value in completed inventory alongside the appeal of under-construction developments. Several positive forces are driving this alignment:

It also reflects greater efficiency and transparency in pricing, where both segments are being driven by real demand fundamentals. It also positions the Abu Dhabi residential market as increasingly investor-friendly, offering opportunities across the project lifecycle whether for early-stage speculators or yield-focused buyers.

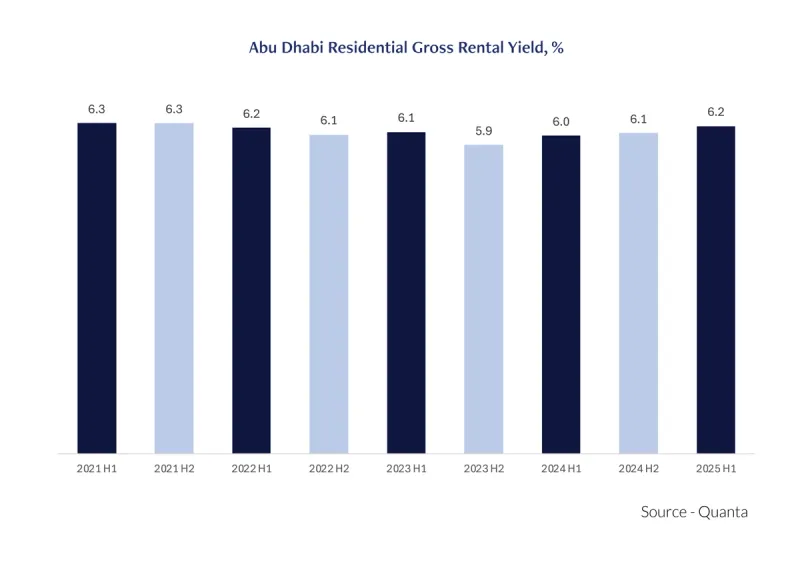

In terms of Abu Dhabi real estate investment trends, the above chart shows that gross residential rental yields in Abu Dhabi for both off plan and ready combined have remained consistently between 5.9% and 6.3% over the five-year period. This reflects a stable income-generating environment for residential investors, with limited volatility even during periods of global and regional economic uncertainty. The consistency in yields signals that rent growth has largely kept pace with capital appreciation, maintaining the market’s attractiveness for yield-driven investors. Yields dipped slightly to 5.9% in H2 2023, likely due to a surge in residential sale prices, particularly in the off-plan segment, which temporarily outpaced rental growth. However, the market quickly adjusted, with yields rebounding to 6.2% in H1 2025, indicating:

This sustained performance reinforces Abu Dhabi’s position as a defensive and income-oriented residential investment market. Yields above 6% when combined with relatively low transaction fees and zero property taxes make the emirate an appealing choice for both regional and international investors seeking stable, medium-term returns in a maturing real estate landscape. The Abu Dhabi office market saw a mix of cyclical and structural variables.

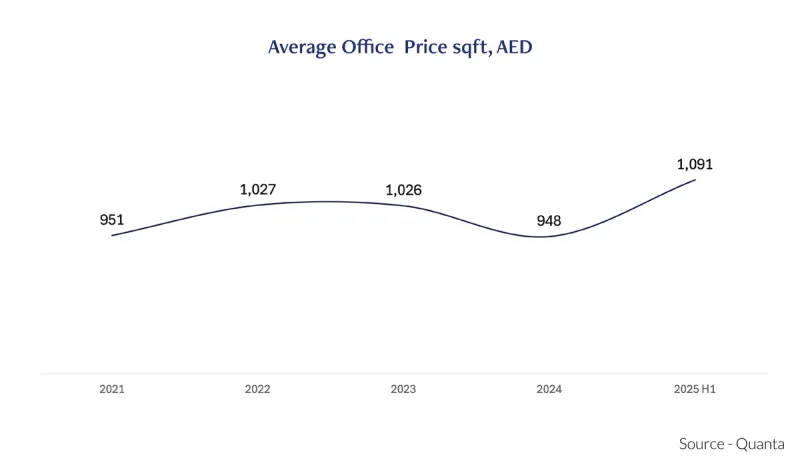

The aftermath of the COVID-19 pandemic and the growing adoption of hybrid work models continued to reshape corporate real estate strategies. Many companies began to right-size their office footprints opting for smaller, more efficient spaces or delaying expansion and relocation plans amid global economic uncertainty. This cautious approach to space planning dampened transactional activity and placed downward pressure on pricing, particularly in secondary business districts.

Certain submarkets in Abu Dhabi saw elevated vacancy rates, particularly among older or non-prime office buildings. These assets, often lacking modern amenities or sustainability features, became less attractive to tenants seeking operational efficiency and enhanced employee experience. The resulting two-speed market where older buildings underperformed pushed down the city-wide average office price.

In contrast, Grade A office buildings in Abu Dhabi, especially those in central business districts and free zones continued to attract sustained demand and have occupancy close to a 100%. These premium assets, offering high-quality infrastructure, flexible layouts, ESG compliance, and tenant-focused services, benefited from the “flight to quality” trend. Despite broader market challenges in 2024, Grade A spaces likely maintained full occupancy rates and stable but increasing rental values, reinforcing investor interest in prime commercial real estate even during periods of correction.

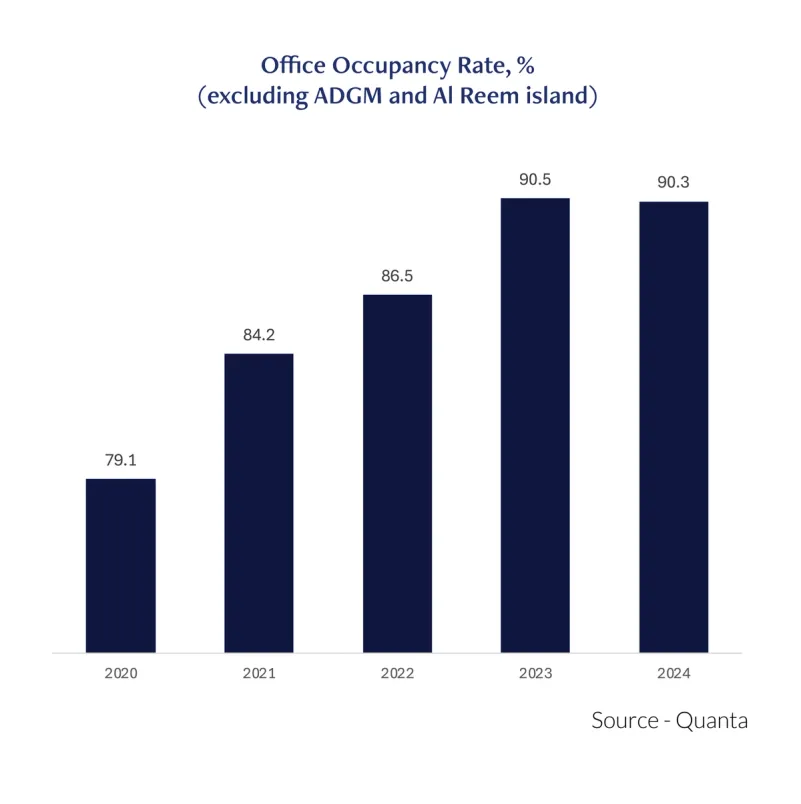

Abu Dhabi’s non-free zone office market has demonstrated a strong recovery trajectory over the past four years, with occupancy levels climbing from a low of 79.1% in 2020 to a robust 90.3% in 2024. This upward movement is indicative of a market that has not only rebounded from the disruptions of the pandemic but also benefited from sustained economic momentum and proactive government-led diversification efforts.

As Abu Dhabi continues to position itself as a regional hub for finance, energy, and innovation, demand for office space outside free zones has gained traction, particularly among local corporates, SMEs, and public sector tenants, fueling Abu Dhabi office occupancy and rental growth.

While occupancy peaked at 90.5% in 2023 and slightly eased to 90.3% in 2024, this marginal softening reflects stabilization rather than weakness, as the market adjusts to evolving workplace strategies and the natural cycle of lease expirations and renewals. Importantly, the market’s ability to hold above 90% occupancy signals as estimated to be seen in the first half of 2025 as well mostly due to healthy absorption rates, growing tenant stickiness, and limited oversupply in non-prime segments.

However, it’s worth noting that this data does not include Free Zones and ADGM, where Grade A office assets continue to perform exceptionally well with occupancy levels exceeding 95%, driven by strong demand from multinationals and financial institutions. This contrast underscores the resilience of prime inventory and highlights a widening performance gap between premium and secondary stock within Abu Dhabi’s evolving office landscape.

Abu Dhabi’s H1 2025 real estate performance reaffirms the emirate’s thesis as a core real asset market in the GCC. With a maturing regulatory framework, yield-accretive opportunities across the spectrum, and defensiveness underpinned by sovereign-backed infrastructure, the capital continues to attract both private and institutional capital.

In a global environment characterised by elevated rates, stagflationary tail risks, and geopolitical bifurcation, Abu Dhabi stands out for its clarity of policy, investability, and potential for long-term alpha generation. For allocators seeking regional diversification and inflation-aligned cash flows, the case for real estate is not only intact—it is strengthening.