7 minutes read

Written by

Liudmilla Gromadzki

Dubai Islands Market Update 24/25 Overview

Updated: Jun 11, 2025, 02:28 PM

Dubai Islands is a large-scale masterplan by Nakheel that plays a central role in supporting the ambitions of the Dubai 2040 Urban Master Plan. Comprising five distinct islands — Central Island, Marina Island, Shore Island, Golf Island, and Elite Island. The project is designed to accommodate a balanced mix of residential, hospitality, retail, cultural, and recreational uses across an expansive 17 square kilometre footprint.

Collectively, the islands deliver over 60 kilometres of waterfront and 20 kilometres of beaches, reinforcing Dubai’s position as a global hub for premium coastal living. The development replaces the original Palm Deira concept with a more diverse and flexible design strategy, creating integrated communities across multiple connected islands, rather than a single-destination layout.

This marks a shift in Dubai’s approach to large-scale coastal developments in 2025, with a greater emphasis on mixed-use livability, tourism, and long-term value creation. Investors seeking Dubai real estate for sale are already watching this transformation closely.

At present, access to Dubai Islands is relatively constrained via the Infinity Bridge and Al Khaleej Street. However, the road network is set to improve significantly with the introduction

of a newly announced 8-lane bridge, awarded by Dubai’s Roads and Transport Authority (RTA).

Once complete, the bridge will support traffic volumes of up to 16,000 vehicles per hour in both directions and will include dedicated pedestrian and cycling infrastructure. Internal mobility between the islands will be facilitated by a series of interconnected bridges and waterfront transport links, ensuring seamless access to key areas.Key Features and Amenities

Each of the five islands offers its own character and development focus, ranging from residential communities and leisure precincts to luxury resorts and lifestyle destinations. The overall vision is to establish a multi-dimensional coastal hub capable of serving residents, tourists, and investors alike. Notable features include:

Dubai Islands offers a wide range of residential typologies, including premium waterfront villas, branded residences, mid-rise apartments, and resort-style communities. Many properties benefit from direct beach access or unobstructed views of the Arabian Gulf, albeit many key beachside plots have been allocated to hotel use. The diversity of product caters to both end users and investors seeking capital appreciation or income-generating assets.

Commanding strong price points and high rental demand due to exclusivity and view

Blending residential, commercial, and retail uses to support long-term occupancy and convenience

Well-positioned for the short-term rental market, targeting Dubai’s growing visitor base

Dubai Islands’ unique combination of scale, location, waterfront appeal, and integrated urban design sets it apart from other masterplans. As new infrastructure comes online and more components are delivered, Dubai Islands are expected to mature into one of Dubai’s most attractive and liveable coastal districts.

For those exploring Dubai real estate for sale, Dubai Islands stands out as one of the few large-scale coastal communities still offering early-stage entry pricing and long-term growth potential.

Dubai Islands is emerging as a strategic, high-growth location within Dubai’s waterfront real estate segment. Supported by robust infrastructure investment and a diverse mixed-use development strategy, its relative affordability compared to other established coastal communities presents a compelling opportunity for both capital appreciation and mid-term value gains. Let’s delve into the most notable Nakheel Dubai Islands updates.

In 2024, the average apartment price for Dubai Islands off-plan projects stood at AED 2,162 per sqft, suggesting it is the most ‘affordable’ waterfront community. This figure compares with:

At AED 2,162 psf, Dubai Islands price per sq ft is 55% lower than Palm Jumeirah off plan stock, and nearly 82% lower than Jumeirah Bay Island, two of Dubai’s most established luxury coastal communities. Dubai Islands would require a price growth of 130% to match the Palm Jumeirah.

This wide price gap suggests that Dubai Islands should be considered undervalued, not due to a lack of product quality or strategic relevance, but rather due to its earlier stage of development and ongoing infrastructure rollout. As development progresses and the area matures, this price differential offers clear upside potential.

Despite its relatively low entry price, Dubai Islands real estate market in 2025 has already shown signs of positive movement. Between 2024 and Q1 2025, the average off-plan apartment price increased from AED 2,162 to AED 2,317, marking a 7% quarterly increase. To understand its longer-term growth potential, it can be benchmarked against Palm Jumeirah and La Mer.

The Palm Jumeirah saw off-plan prices increase from:

This represents a 15% increase over 5 years.

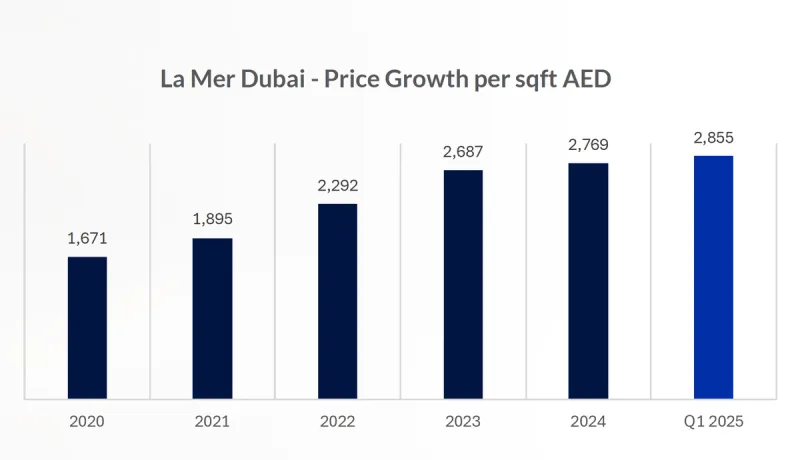

La Mer has seen similar total price growth per sq. ft in recent years:

This represents a 70.8% increase over the last 5 years.

If Dubai Islands were to follow a similar trajectory, supported by maturing infrastructure, growing investor interest, and a growing lifestyle ecosystem, investors could see substantial returns on their money.

In 2024, Dubai Islands recorded 1,091 off-plan apartment transactions, placing it only behind the following waterfront communities.

This level of activity suggests growing market confidence and developer momentum. It indicates that Dubai Islands is resonating with both investors and end users, despite its early development phase.

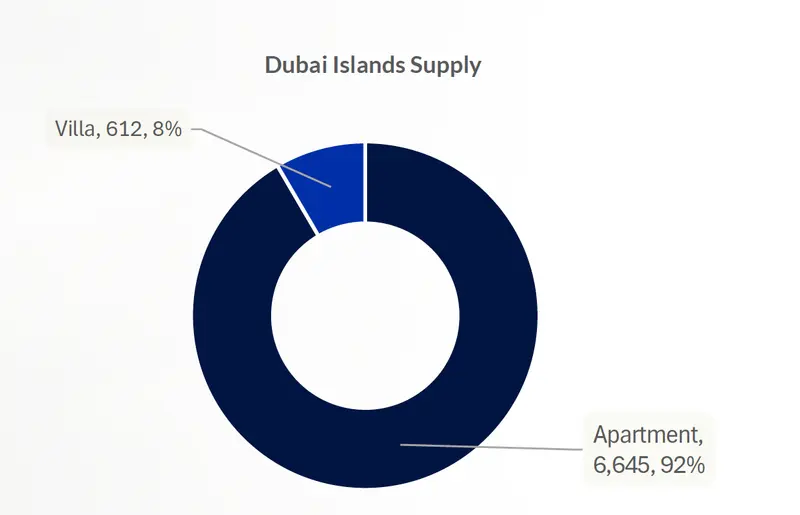

The majority of residential stock at Dubai Islands consists of apartments (92%), with villas making up just 8% of the current supply. This aligns well with both local and international investor demand patterns in Dubai, where apartments are preferred for short-term rental income and liquidity.

Villas on Dubai Islands will cater for the luxury segment and HNWI’s and given the lack of supply and high demand; Dubai Islands villa prices could see the highest growth over the coming years.

This supply profile does however ensure the area remains relatively affordable and accessible to a broader range of buyers, including first-time investors and residents seeking lifestyle-led homes with water access.

Dubai Islands investment opportunities are compelling for investors looking to enter Dubai’s luxury waterfront market at a relatively low cost basis with strong upside potential. The data reveals several critical takeaways:

Dubai Islands continues along a price trajectory similar to Palm Jumeirah — supported by infrastructure rollouts like the new 8-lane bridge, growing hospitality offerings, and improved connectivity — it may offer substantial price appreciation over the next 3-5 years.

For investors with a medium to long-term outlook, the current market entry point represents a rare window of opportunity to secure assets in a master planned, beachfront destination with room for capital growth and strong underlying demand fundamentals.

For further insights and comprehensive real estate advisory services, please contact Driven Properties at +971800374836