1 minute 48 seconds

Written by

Sam Parsons

Dubai Real Estate Market April 2026 YoY Insights Revealed

Updated: May 14, 2025, 04:34 PM

Dubai’s residential market continued its strong performance into April 2025, with YoY growth evident across both sales and rental segments. Let’s dive deeper into Dubai real estate sales trends.

The below report on Dubai real estate market performance draws data from Reidin, summarizing key findings pertaining to Dubai property transaction data across the secondary market, off-plan market, and rental market for April 2025, including both cash and mortgage transactions.

Dubai Real Estate April 2025 stats reiterate once again the sector’s steady growth.

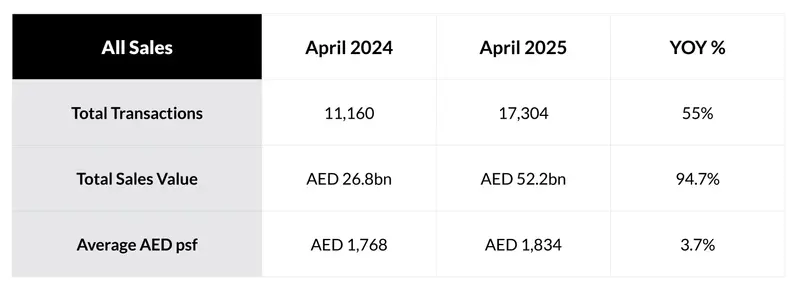

Total sales transactions for April 2025 increased by 55% compared to April 2024, reaching over 17,300 transactions. The overall value of residential sales nearly doubled, rising by 94.7% to AED 52.2bn highlighting not just higher activity but larger transaction sizes and perhaps a shift toward more premium properties.

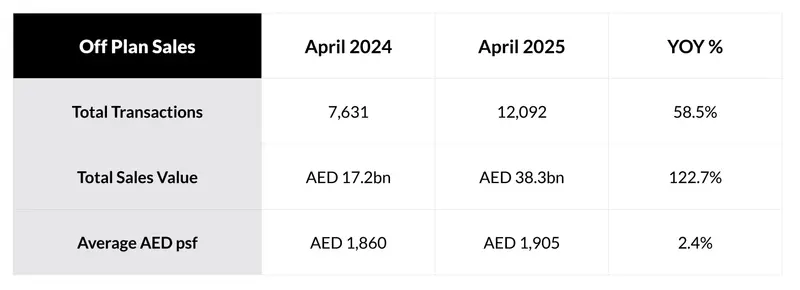

Dubai's off-plan sales in April 2025 were the main driver of this growth. Transactions in this segment increased by 58.5%, while sales value surged by 122.7% suggesting strong investor appetite for new launches and ongoing confidence in Dubai’s development pipeline.

The average off-plan price per square foot rose by just 2.4% however, indicating that the bulk of value growth likely stemmed from increased volume and higher value launches.

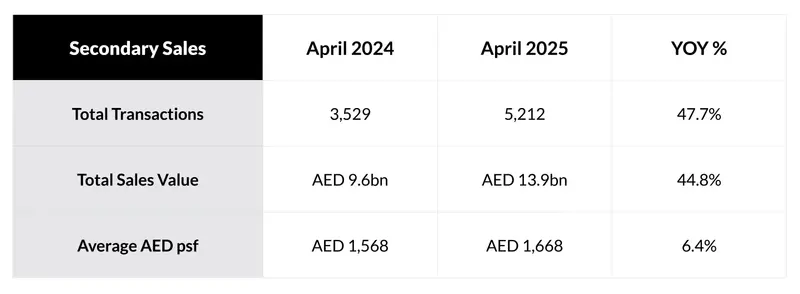

Secondary market activity also showed significant growth with transactions rising 47.7% and total value increasing by 44.8%. Notably, the average price per square foot in the secondary market rose by 6.4%, outpacing off-plan growth and reflecting upward pricing pressure on completed ready units.

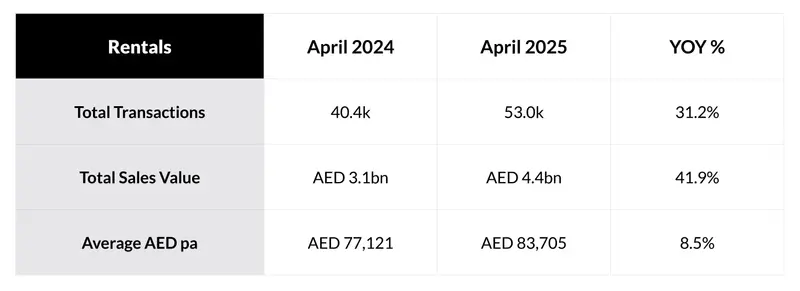

The rental market saw a 31.2% increase in transaction volume, while rental value rose 41.9% YoY to AED 4.4bn. Average annual rents climbed 8.5% to AED 83,705, showing continued upward momentum amid high occupancy and tenant demand.

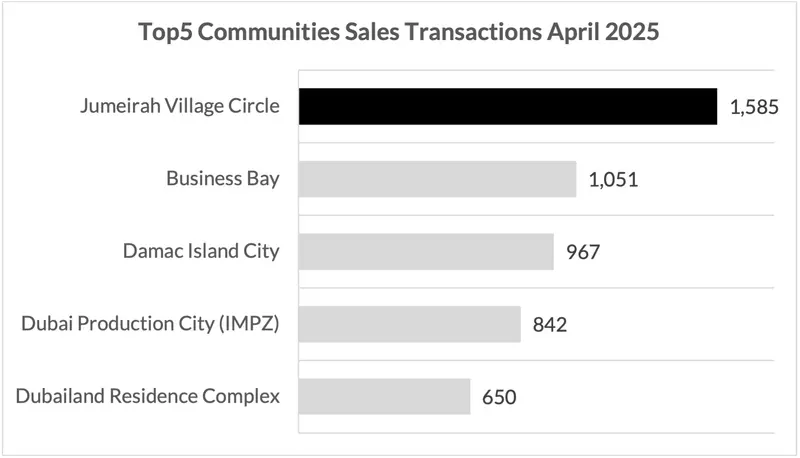

Communities leading the way in terms of sales transactional volume included Jumeirah Village Circle, Business Bay, Damac Island City, Dubai Production City (IMPZ), and Dubailand Residence Complex; classifying these among the popular areas to invest in Dubai.

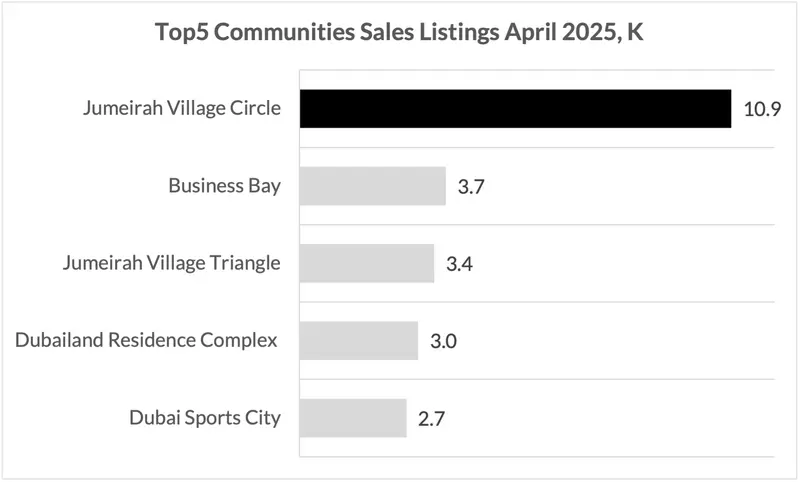

Jumeirah Village Circle notably tops the list in terms of sales listing volume in April 2025, with over triple the amount of listings than most other communities, including Business Bay, Jumeirah Village Triangle, Dubailand Residence Complex, and Dubai Sports City.

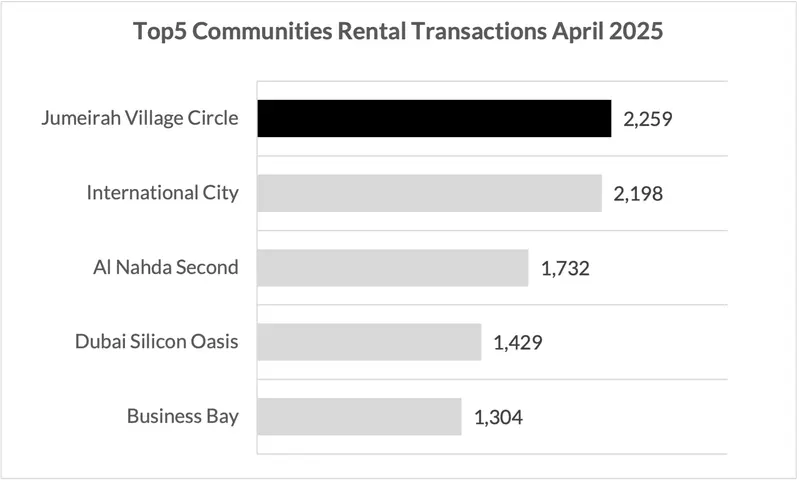

Meanwhile, communities leading the way in terms of rental transactional volume included Jumeirah Village Circle, followed closely by International City, Al Nahda Second, Dubai Silicon Oasis, and Business Bay.

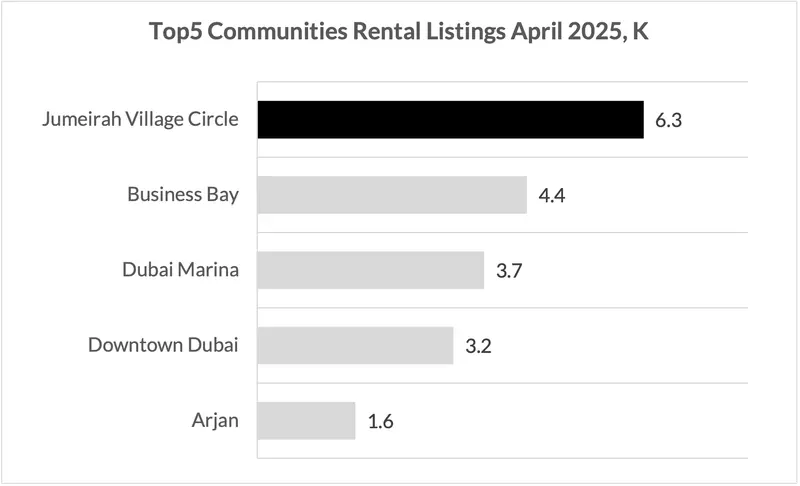

Jumeirah Village Circle also tops the list in terms of rental listing volume, followed by Business Bay, Dubai Marina, Downtown Dubai, and Arjan.

When looking at year-on-year real estate growth in Dubai, April 2025 reinforces the broader strength of Dubai’s residential market, with both transactional activity and values accelerating, led by off-plan and supported by significant gains in the rental market.