2 minutes 15 seconds

Written by

Liudmilla Gromadzki

Dubai Real Estate Market May 2026 YoY Insights Revealed

Updated: Jun 10, 2025, 09:25 AM

Through May 2025, Dubai's residential market maintained its impressive performance, with year-over-year increase in both the sales and rental divisions. Let's examine Dubai real estate sales patterns in more detail.

The below report on Dubai real estate market performance draws data from Reidin, summarizing key findings pertaining to Dubai property transaction data across the secondary market, off-plan market, and rental market for May 2025, including both cash and mortgage transactions.

Dubai Real Estate May 2025 stats reiterate once again the sector’s steady growth and rising demand for Dubai real estate for sale across multiple communities.

Dubai Real Estate May 2025 stats reiterate once again the sector’s steady growth.

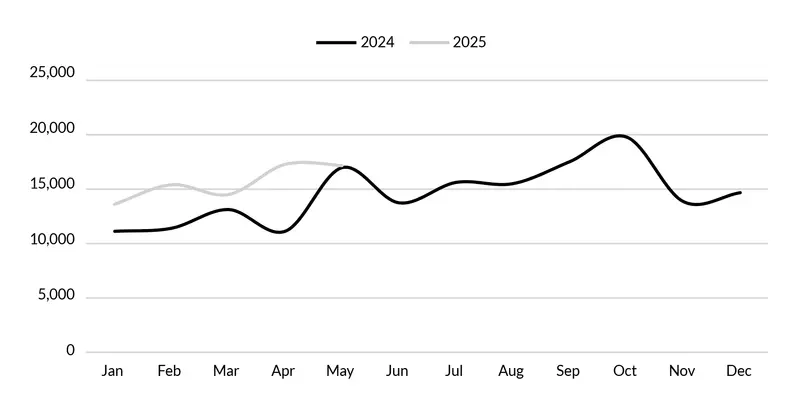

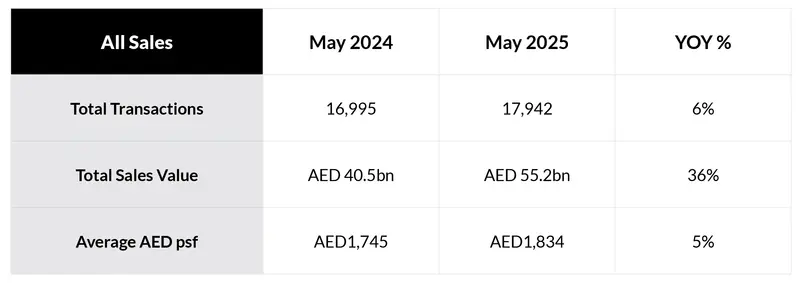

The Dubai property market recorded a total of 17,942 transactions in May 2025, marking a 6% increase compared to the same month in 2024. The total sales value surged by 36% year-on-year, reaching AED 55.2 billion. The average price per square foot also rose to AED 1,834, a 5% increase.

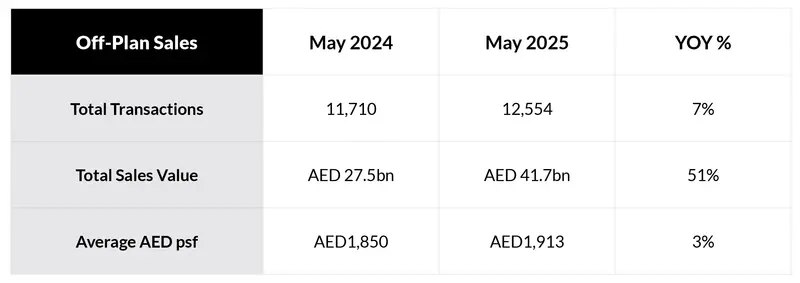

Off-plan activity remained dominant in May, with 12,554 transactions recorded—up 7% from May 2024. The value of these sales saw a significant 51% year-on-year rise, reaching AED 41.7 billion, which strongly suggests that the market is seeing larger or more expensive off plan units being absorbed.

The average price per square foot for off-plan properties increased slightly to AED 1,913, reflecting steady appreciation and investor confidence in future developments.

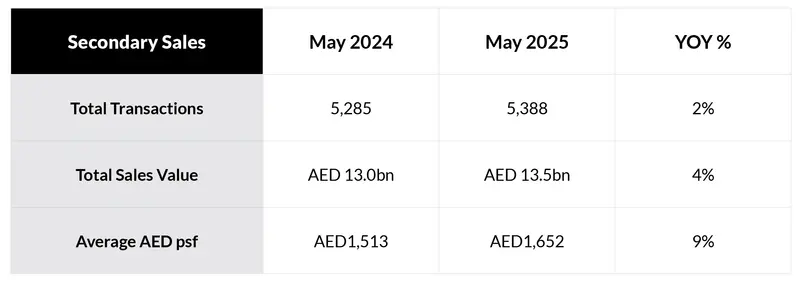

Secondary market transactions showed modest improvement, with 5,388 deals in May 2025—just a 2% increase from a year ago. However, the total value of sales rose by 4% to AED 13.5 billion.

Notably, the average price per square foot increased by 9% to AED 1,652, suggesting that while volume growth was limited, pricing power in the resale segment is strengthening. This growth can be attributed to a variety of factors, the most significant of which could be a shortage of desirable ready units in the market. The consistent absorption of units further highlights buyer trust in Dubai real estate for sale and its long-term stability.

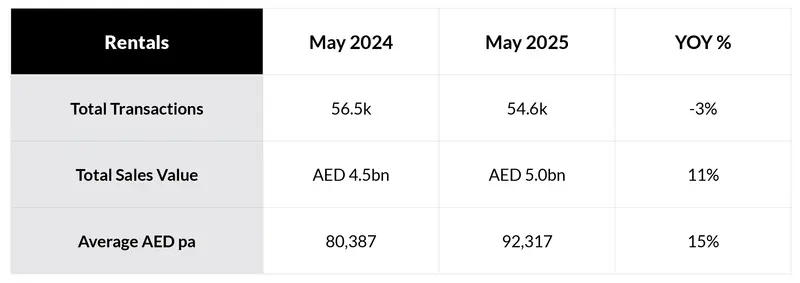

The rental market experienced a slight dip in activity, with 54,600 contracts registered in May 2025—down 3% year-on-year. Despite this, the total rental value grew by 11% to AED 5 billion, and the average annual rent increased sharply by 15% to AED 92,317.

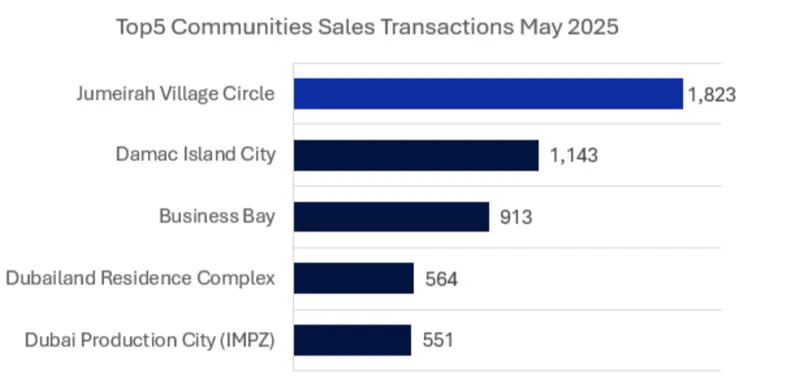

Jumeirah Village Circle (JVC) continued to lead in transactional volume with 1,823 sales, followed by Damac Island City (1,143) and Business Bay (913). Dubailand Residence Complex and Dubai Production City also made the top five, reflecting sustained demand for affordable to mid-tier communities that offer a mix of investor and end-user appeal.

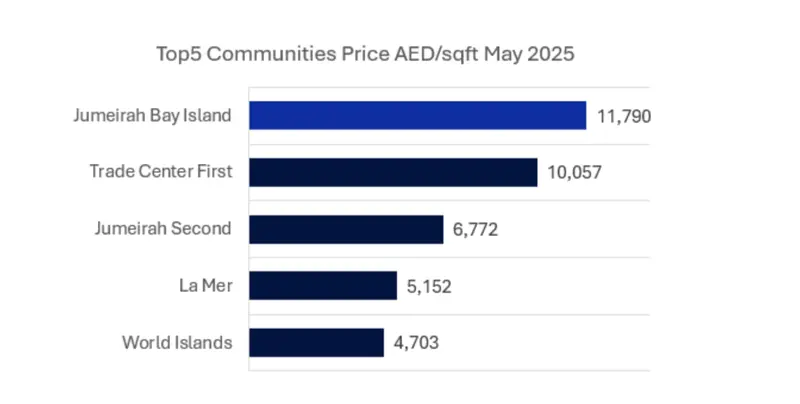

The most expensive communities by average price per square foot were led by Jumeirah Bay Island at AED 11,790, followed by Trade Center First at AED 10,057. Jumeirah Second, La Mer, and the World Islands also featured in the top five.

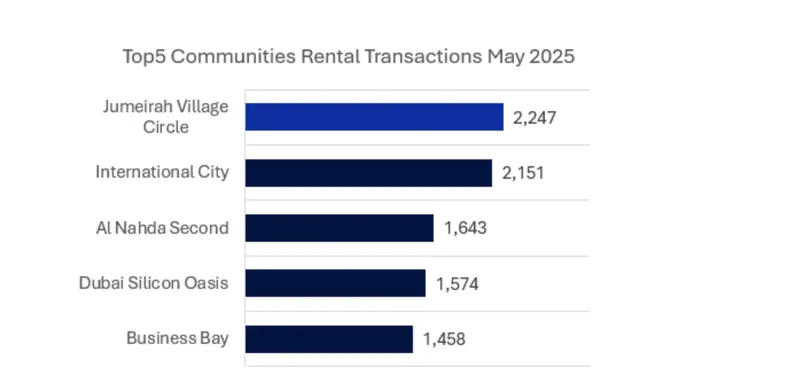

Jumeirah Village Circle topped the rental market with 2,247 transactions, indicating its popularity among tenants for affordability and accessibility. It was closely followed by International City (2,151) and Al Nahda Second (1,643). Dubai Silicon Oasis and Business Bay rounded out the top 5 list, each offering a diverse mix of residential stock catering to professionals and families alike.

When examining Dubai's real estate growth year over year, May 2025 highlights the residential sector's overall strength, with off-plan transactions and values rising at a rapid pace, bolstered by notable improvements in the rental market.

For further insights and comprehensive real estate advisory services please contact Driven Properties at +971800374836