4 minutes 5 seconds

Written by

Liudmilla Gromadzki

The Post-Non-Dom Era: Why Dubai Real Estate Is Emerging as a Tax Haven for UK Investors in 2026

Updated: May 05, 2025, 04:44 PM

Historically, the UK’s appeal to global wealth was underpinned by a pragmatic and permissive tax regime. Non-domiciled residents—whose permanent home was considered outside the UK—could live in Britain indefinitely while paying tax only on UK-sourced income. Foreign income and gains were taxed only if "remitted" to the UK. Wealth structuring tools such as offshore trusts, Business Investment Relief, and asset rebasing allowed high-net-worth individuals (HNWIs) to plan for the long term with a high degree of certainty and efficiency.

As of April 2025, that era is officially over.

For more than 200 years, the “Res Non-Dom” regime made the UK—and particularly London—a magnet for global capital. The ability to shield non-UK income and gains was not just a tax benefit; it was a structural advantage in the global competition for wealth migration. That competitive edge has now been lost.

Sweeping reforms, initiated by the Labour Party in anticipation of political change, have abolished domicile status as a tax concept and ended the remittance basis. From April 2025, a residence-based system replaces the previous model, taxing all UK residents on their worldwide income and gains as they arise. A limited four-year exemption—the new Foreign Income and Gains (FIG) regime—will apply only to new arrivals who have been non-resident for at least ten years.

While the stated goal is greater tax equity, the practical effect is a fundamental shift in how global wealth views the UK. Capital is mobile—and so are the individuals who control it. The response has been swift: inquiries into wealth migration are rising, offshore trust planning is accelerating, and attention is turning to jurisdictions that offer both tax efficiency and asset security.

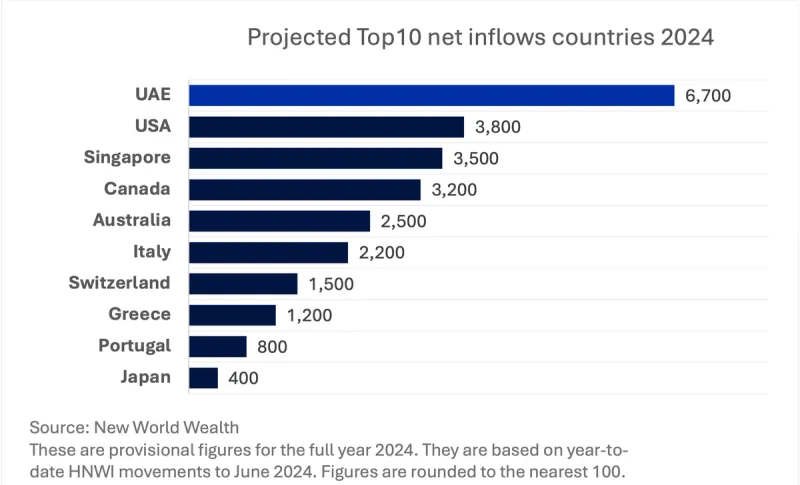

The global migration data shows many Ultra High Net Worth Individuals are relocating to Dubai. Wealth migration is no longer just a reaction to tax increases; it is a rational reassessment of risk, opportunity, and the value of remaining in an increasingly complex fiscal environment.

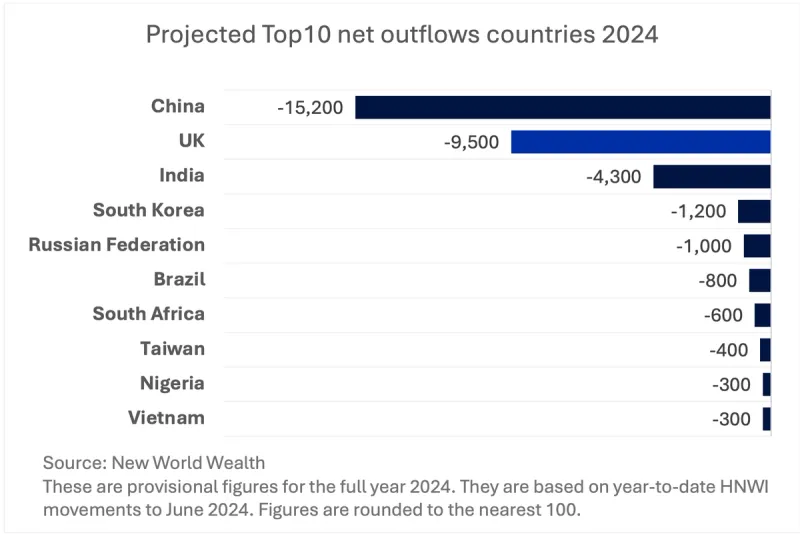

In 2024 alone, the UK experienced a net outflow of approximately 9,500 millionaires—the highest of any country worldwide, according to data from Henley & Partners. This trend is accelerating, with HNWIs increasingly relocating to jurisdictions such as the UAE, Singapore, and Switzerland in search of more favourable tax treatment, regulatory stability, and long-term wealth security.

As the global wealth landscape undergoes seismic change—particularly following the UK’s abolition of the non-domicile regime—see why investors are actively re-evaluating their options. The emergence of Dubai as a tax haven for UK HNWIs among other destinations is not unexpected. Dubai stands out as a premier jurisdiction for capital relocation, wealth preservation, and long-term planning. Dubai relocation for wealthy individuals is becoming increasingly prevalent.

This transformation is no accident. Dubai's emergence as a financial hub is the result of deliberate investment in infrastructure, regulatory development, and global integration. Today, the emirate offers a tax-neutral, politically stable, and investor-centric environment—positioning it as a strategic alternative to traditional financial centres such as London.

The below examples serve as the main reasons behind UK High Net Worth Individuals relocating to Dubai.

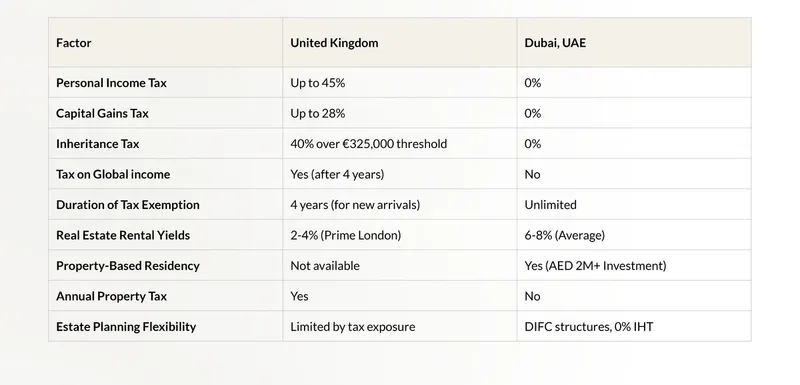

Dubai provides a uniquely transparent and advantageous tax regime. There are no personal income taxes, capital gains taxes, inheritance taxes, or annual property taxes. Individuals are not taxed on global income, and there are no wealth or dividend taxes. In contrast to the UK's increasingly complex and politically sensitive tax landscape, the tax benefits for HNWIs in Dubai offer true simplicity—free from remittance planning, mixed fund analysis, or statutory residence tests.

This clarity and predictability have positioned Dubai as one of the most attractive jurisdictions globally for high-net-worth individuals seeking long-term financial efficiency.

Real estate lies at the heart of Dubai’s appeal as a global wealth anchor. For both international and UK-based investors, it offers a compelling combination of income yield, capital preservation, and estate planning advantages:

Freehold ownership available to non-citizens in designated areas

No annual property taxes or restrictions on capital and rental income repatriation

Assets can be structured through trusts, foundations, or offshore vehicles for multi-generational wealth transfer

With average gross rental yields between 6–8%, Dubai property significantly outperforms prime London yields (2–4%). Capital appreciation is driven by sustained demand, a controlled premium supply pipeline, and robust population growth.

The Dubai International Financial Centre (DIFC) operates under a common law framework, providing legal familiarity and certainty for British and international investors.

The Real Estate Regulatory Agency (RERA) enforces strong investor protections, including escrow regulations and title transparency.

Dubai has significantly enhanced its anti-money laundering (AML) framework and has adopted international financial reporting standards (IFRS), reinforcing transparency and credibility.

Moreover, Dubai is not blacklisted under major international tax treaties, ensuring continued access to global banking, investment services, and cross-border financial platforms—a critical factor for globally mobile families.

Dubai's real estate sector also serves as a gateway to long-term residency:

An investment of AED 2 million+ (~£430,000) in real estate qualifies for the UAE’s 10-year Golden Visa, providing long-term residence without the need for employment or local sponsorship.

The abolition of the UK’s non-dom regime is not merely a policy shift—it marks a turning point in the nation’s investment identity. As London’s historical status as a global wealth centre becomes less sustainable for international investors, Dubai has emerged as its strategic counterpart: tax-efficient, globally integrated, and focused on future-proofing wealth.

For UK-based HNWIs now facing reduced flexibility and increased exposure, Dubai offers more than just a safe haven. It represents the strategic cornerstone of a new global wealth strategy—enabling long-term preservation, growth, and intergenerational transfer in a rapidly evolving financial landscape.