2 minutes read

Written by

Liudmilla Gromadzki

Downtown Dubai Residential Market Update 24/25 Overview

Updated: Jun 11, 2025, 04:41 PM

Dubai’s residential market in Q1 2025 has maintained its momentum and posted strong year-on-year growth across all key indicators, with total transaction volumes increasing by

22.8%, and the total value rose by 28.9% compared to the same period in 2024. Let’s discuss further the major Downtown Dubai real estate updates as well as real estate trends in Dubai in 2025.

At Driven Properties, our expert agents have completed over 125 deals in Downtown for our investor clients within the last 12 months, with a total property value in excess of AED 685 million.

To highlight, there were 1,121 Q1 2025 overall transactions, with 291 off-plan and 830 secondary transactions. The total value amounted to AED 4.9 billion (6.5% YoY increase).

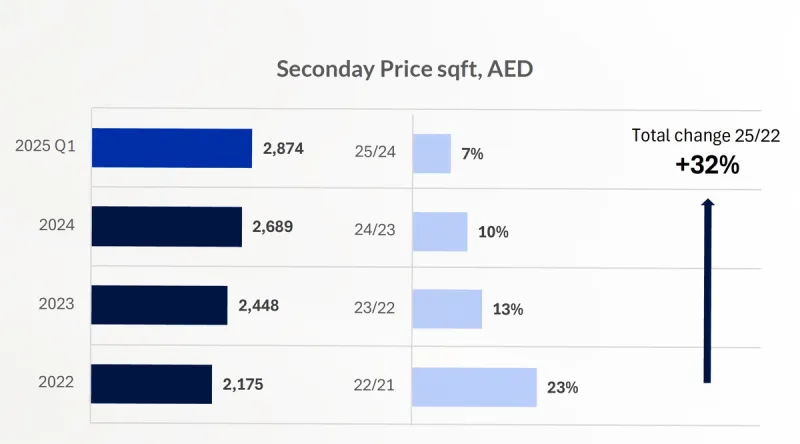

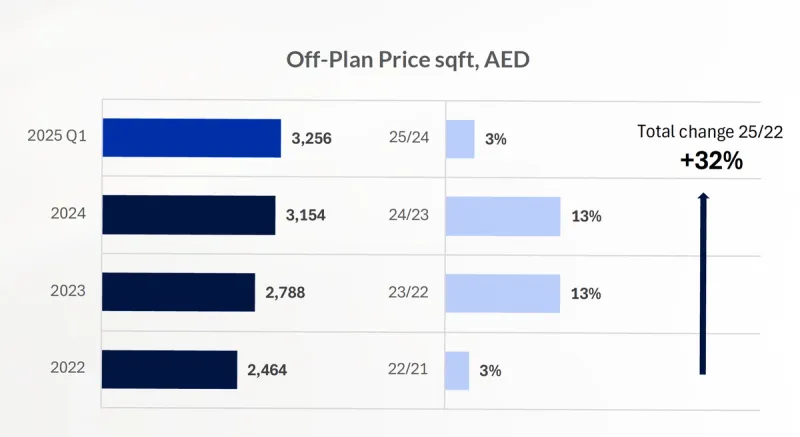

In addition, the Q1 2025 average sales price per sq. ft is AED 2,972, with AED 3,256 for off-plan and AED 2,874 for secondary.

Reasons to Invest in Downtown Dubai:

Downtown Dubai property market in 2025 has sustained a consistent growth trajectory over the past several years, reinforcing investor and end-user confidence in the area’s long-term value and stability. When looking at secondary vs off-plan in Dubai, both segments have experienced positive year-on-year (YoY) growth in sales prices, reflecting continued demand and strong market fundamentals.

Driven Properties provides full services for all buyers and sellers, as well as sourcing off-market opportunities due to our agents’ contacts and area expertise. One of our expert agents successfully sourced, managed and sold a block deal of 6 units on the 45th floor for a private investor in The Address Downtown, capturing significant returns and all within one year.

Average sales prices in the secondary market have increased from AED 2,448 per square foot in 2023 to AED 2,689 in 2024, representing a 9.8% annual increase. In Q1 2025, prices have further risen to AED 2,874 per square foot, marking an additional 7% increase. This upward trend highlights sustained demand for completed, ready-to-move-in units, driven by both local end users and international investors seeking immediate returns or usage.

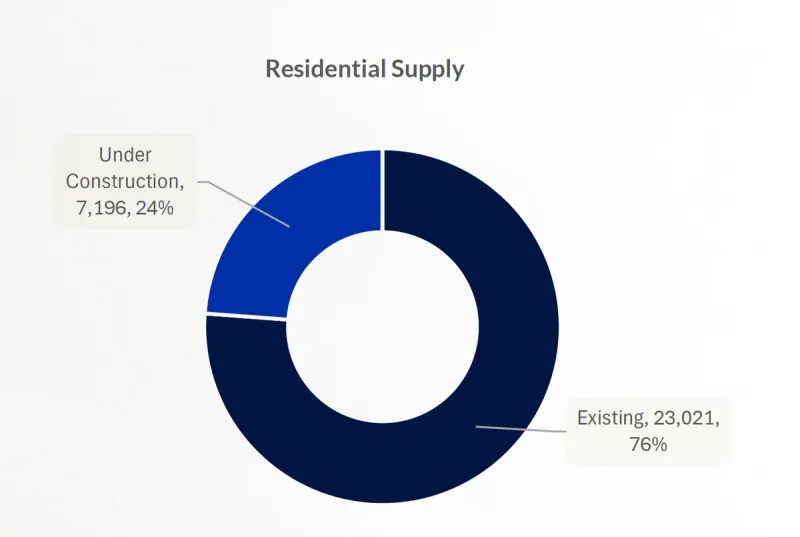

Downtown Dubai off-plan projects have also seen price appreciation, though at a slower pace over the last year. Prices increased from AED 2,788 per square foot in 2023 to AED 3,154 in 2024 (13% increase), and have slightly edged up to AED 3,256 in Q1 2025 (3% increase). However, given the relative lack of supply and future developments compared to the rest of the city, these prices are expected to grow substantially over the coming years.

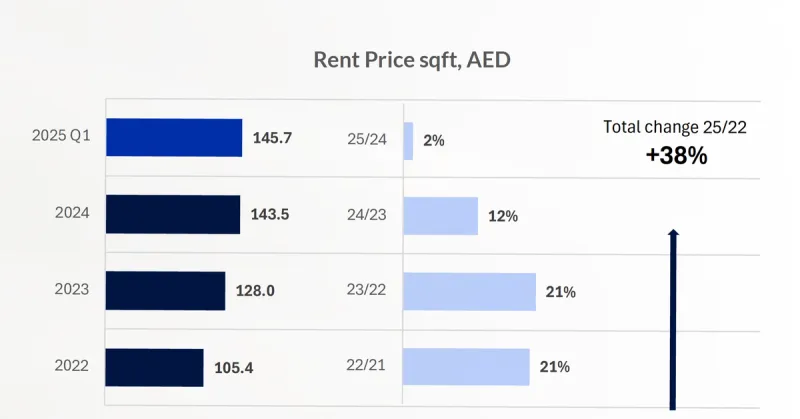

The rental market has mirrored the sales trends with a continued upward trajectory, although the pace of growth has also moderated at the start of 2025. A more accurate and telling story of how the rental market is performing will become more apparent towards the middle and end of 2025, drawing a clearer picture of Dubai rental market trends in 2025.

Rental yields have seen a small drop-off in Q1 2025 compared to 2024 due to capital appreciation increasing at a slightly higher rate than rental appreciation.

Average rents for all leases have increased from AED 128 per square foot in 2023 to AED 143.5 in 2024 (12% increase). In Q1 2025, rents have further climbed to AED 145.7 per square foot (2% increase).

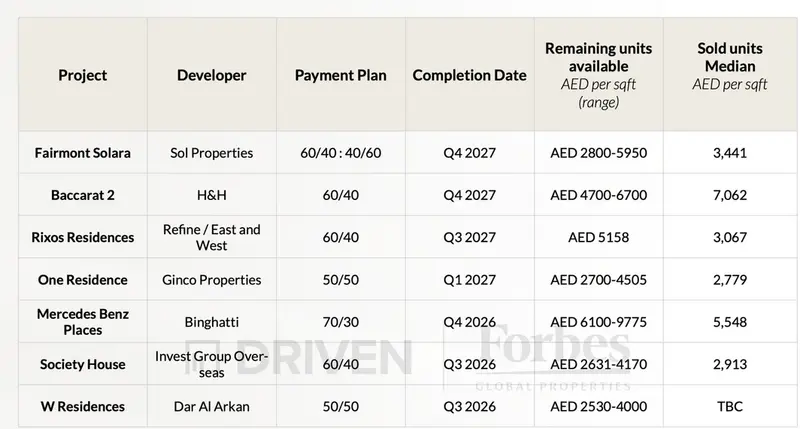

The table below highlights a selection of off-plan developments that will be delivered within the next 3 years in Downtown. Data includes current pricing for remaining units alongside the Median price per sqft achieved since launch

The table below highlights the performance of renowned developments, already completed within Downtown Dubai and analyses the change in average price per sqft from 2022 to Q1 2025. The average rental price per sqft has also been included.

Sought-after projects in Downtown Dubai have seen price increases of up to 50% since 2022, far outperforming the area’s current average of AED 2,973 per sqft.

Rental rates in these developments also exceed the Downtown average of AED 146 per sqft, reaching up to AED 246 per sqft. This performance highlights the strong capital growth and rental income potential of investing in high-quality, in-demand buildings, reinforcing the case for targeted investment in Downtown Dubai’s most established buildings.

Please contact Driven Properties for any enquiries relating to these properties or any other Downtown investment opportunities.

The data suggests that Downtown Dubai remains a resilient and attractive submarket, supported by its prime location, world-class infrastructure, and ongoing development initiatives, particularly in the branded residences sector. The robust growth in secondary sales prices over recent years signals strong demand for completed units, underpinned by investor confidence in capital appreciation and high-quality assets.

Data suggests that Downtown Dubai appears to be transitioning from a high-growth area into a more mature phase of the market cycle, where capital values are stabilizing at elevated levels, and rental yields may begin to normalize – current Q1 2025 gross yields for all bedrooms sit at 6.2%.

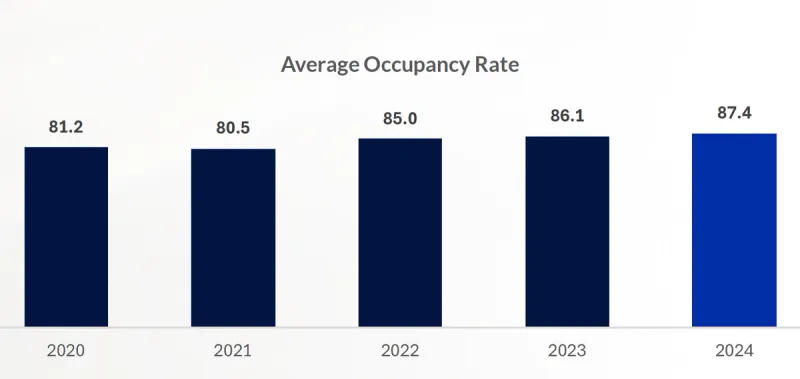

However, its position as a flagship destination within Dubai continues to underpin long-term value for both investors and residents and continues to be a highly sought-after community to reside. Occupancy levels have seen a strong bounce back since 2020, rising from 81.2% to 87.4% in 2024.

For further insights and comprehensive real estate advisory services, please contact Driven Properties at +971800374836