2 minutes read

Written by

Liudmilla Gromadzki

Dubai Hills Market Update 24/25 Overview

Updated: Jun 04, 2025, 10:27 AM

Dubai’s residential market in Q1 2025 has maintained its momentum and posted strong year-on-year growth across all key indicators, with total transaction volumes increasing by

22.8%, and the total value rose by 28.9% compared to the same period in 2024. Let’s dive into Dubai’s real estate market, and specifically tackle Dubai Hills market update for the year 2024 and 2025.

At Driven Properties, our expert agents have completed over 144 deals in Dubai Hills for our investor clients within the last 12 months, with a total property value in excess of AED 475 million.

To highlight, there were 1,069 Q1 2025 overall transactions, with 712 off-plan and 357 secondary transactions. The total value amounted to AED 3.87 billion (614% YoY decrease).

In addition, the Q1 2025 average sales price per sq. ft is AED 2,428, with AED 2,477 for off-plan and AED 2,331 for secondary.

Reasons to Invest in Dubai Hills:

Dubai Hills capital appreciation continues to demonstrate strength across both apartment and villa segments, with prices rising steadily YOY in nearly all categories. Despite a slight softening in transaction volume and value in Q1 2025 compared to the previous year, pricing resilience, particularly in the villa and off-plan segments, signals continued end-user and investor confidence in the community’s long-term fundamentals.

A recent exclusive client of Driven Properties purchased a 4-bedroom villa in Sidra 1 for AED 7.9 million. Following a full renovation over the course of three months, the property has now sold for AED 11 million, generating an impressive return of approximately 11% for the investor. The client is now actively seeking their next project.

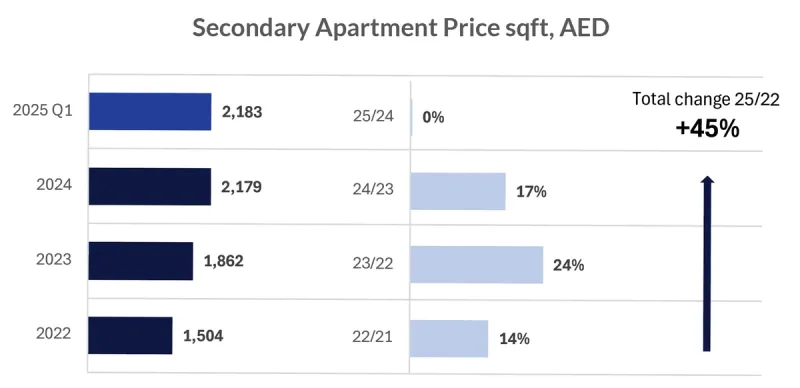

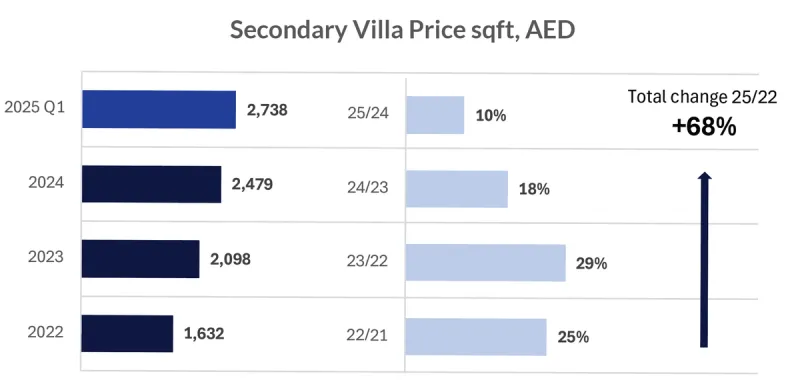

Between 2022 and Q1 2025, Dubai Hills Estate has seen a 45% increase in secondary apartment prices and a notable 68% increase in secondary villa prices.

According to our Dubai Hills real estate report, apartment prices stabilised in Q1 2025 at AED 2,183 psf following strong growth in 2023 and 2024, while Dubai Hills villa prices continued to rise, reaching AED 2,738 psf in Q1 2025. This divergence reflects heightened demand for ready villas in the community, underscoring the

increasing preference among end users and investors (particularly among cash buyers and quick movers) for larger, ready-to-occupy homes in premium suburban settings.

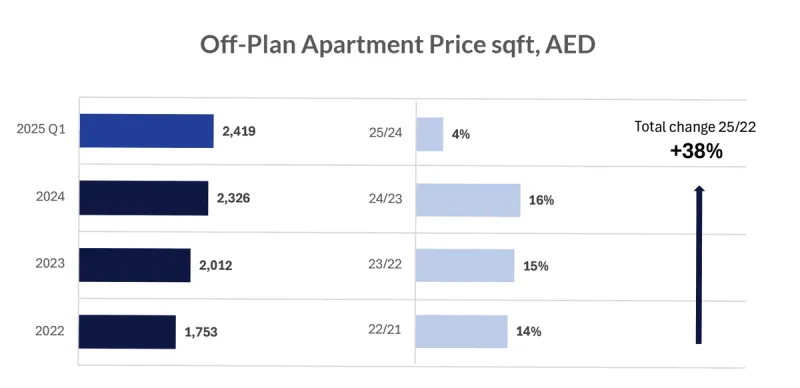

The off-plan segment in Dubai Hills Estate has delivered strong capital appreciation, particularly over the past three years. Average off-plan apartment prices have climbed from AED 1,753 psf in 2022 to AED 2,419 psf in Q1 2025, reflecting a 38% increase. While annual growth was relatively consistent between 2022 and 2024, the pace has moderated in early 2025, with just a 4% increase since the end of 2024, indicating potential stabilisation in Dubai Hills apartment prices for now.

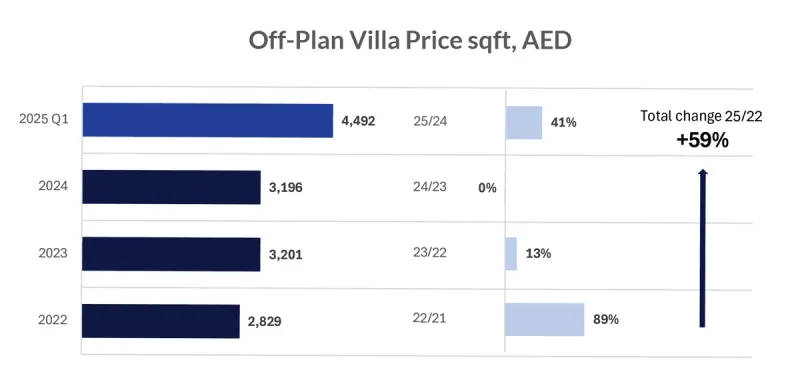

Off-plan villas, however, have seen more volatile but impressive gains, rising from AED 2,829 psf in 2022 to AED 4,492 psf in Q1 2025: a 59% increase. Notably, the majority of this uplift came in just the past quarter, with prices soaring 41% between 2024 and Q1 2025 alone. This kind of spike is highly unusual and likely suggests a sharp supply-demand imbalance and lack of available remaining villa plots.

In terms of ready vs off-plan properties in Dubai; despite these strong figures, it’s important to note that ready properties have actually outperformed off-plan properties in both villas and apartments. This divergence could reflect scarcity of ready stock in a maturing, low vacancy community, as well as buyer preference for immediate occupancy or rental income. That said, off-plan still offers strong upside potential, especially when timed around key launch cycles or phases within premium sub-communities.

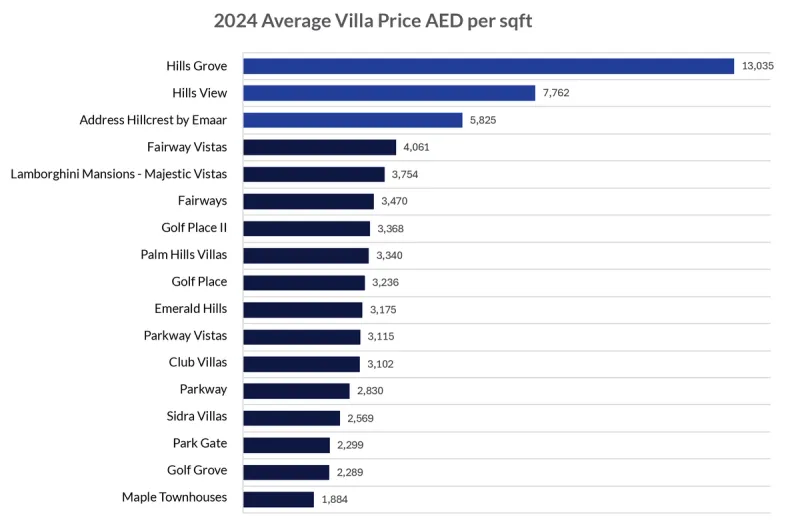

The highest price paid for a villa in Dubai Hills in 2024 was AED 200 million in Hills Grove, whilst the lowest price paid for a villa was AED 2 million in Maple (Townhouses).

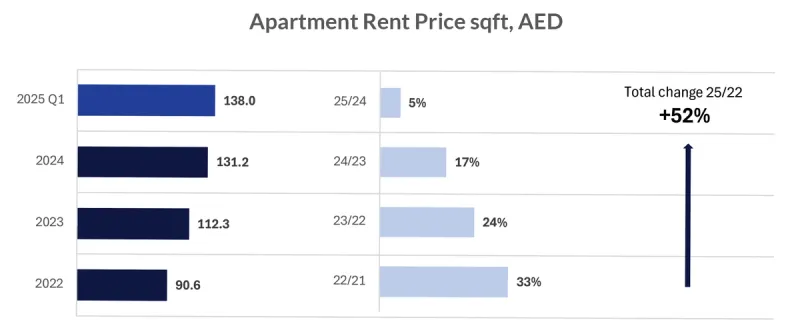

The rental market in Dubai Hills Estate has demonstrated robust growth in recent years, closely tracking the strong performance of Dubai Hills sales market. Between 2022 and Q1 2025, average apartment rents increased by 52%, rising from AED 90.6 per sqft in 2022 to AED 138 in Q1 2025.

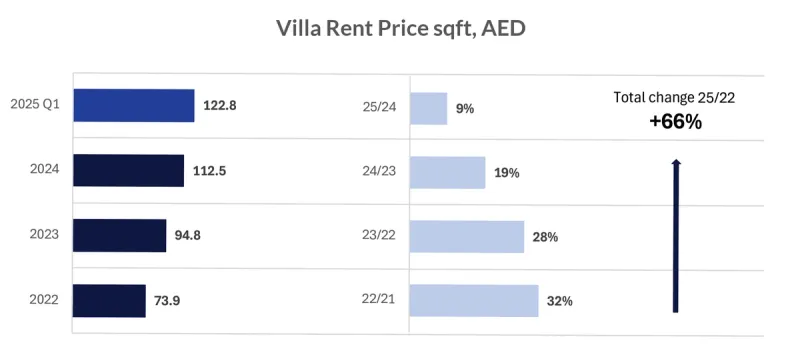

Villa rents rose even more sharply, by 66%, from AED 73.9 per sqft to AED 122.8 over the same period. This substantial rental growth has been underpinned by a consistent rise in demand, limited availability of high-quality rental stock and the area’s increasing appeal among affluent tenants.

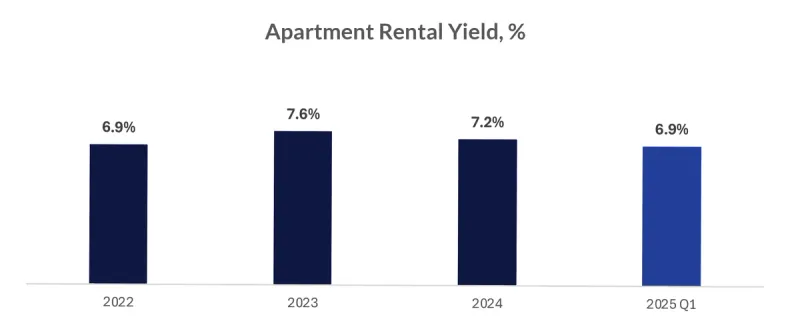

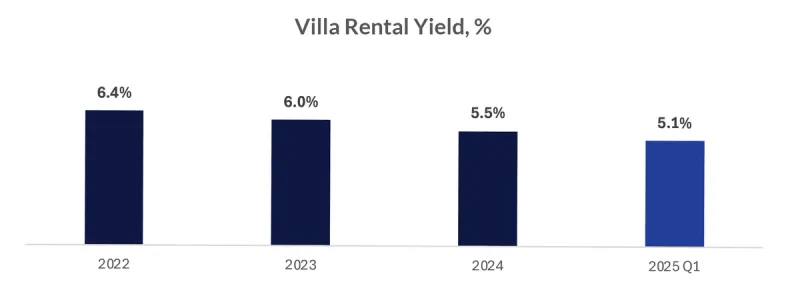

Despite this strong rental growth, rental yields have shown a steady decline since 2022. Apartment yields held flat at 6.9% in Q1 2025 (down from a peak of 7.6% in 2023), while villa yields have declined more sharply from 6.4% to 5.1% over the same period. This yield compression appears counterintuitive given that apartment rents have risen by 52% versus a 45% increase in sale prices over the period, meaning rent growth has actually outpaced capital appreciation.

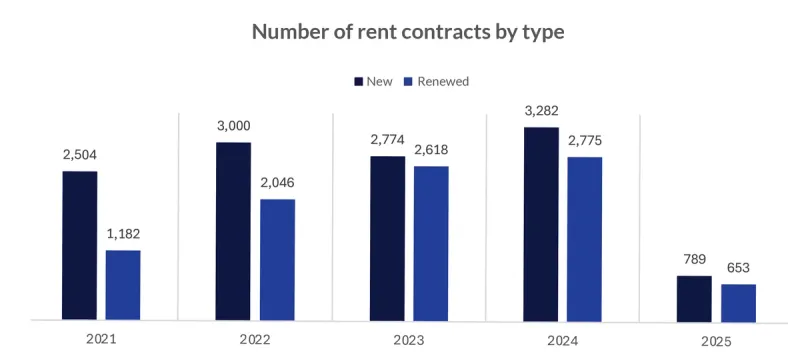

The explanation likely lies in the changing composition of lease activity. As shown in the latest contract data, the number of renewed contracts has increased each year and is now almost on par with new contracts. In 2021, renewed leases made up just 32% of total activity; by 2024, they accounted for 46%, and in Q1 2025, that figure has risen further. Renewals typically yield smaller annual uplifts due to RERA rent cap limitations, meaning headline rental growth doesn’t always translate into higher income for landlords. In essence, while asking rents have surged, landlords are not always able to reflect these gains if tenants remain in place. This explains why Dubai Hills rental yields are compressing despite a robust rental market. Other contributing factors include a maturing investor base prioritising long-term asset value, and a shortage of new high-quality rental stock limiting investor options.

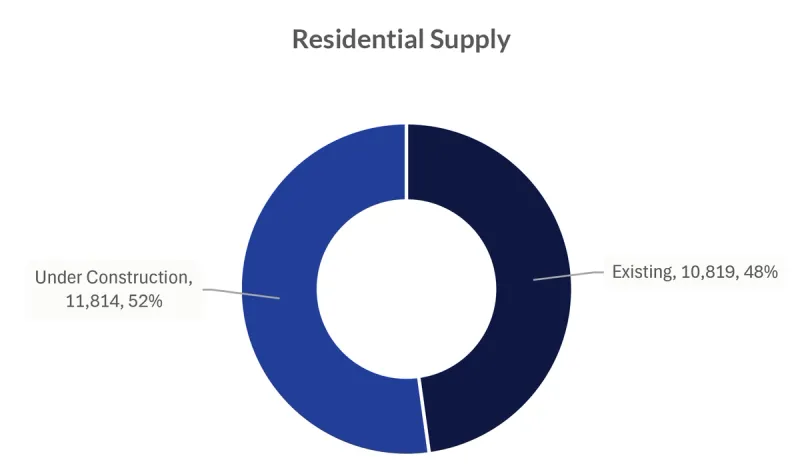

Dubai Hills has a total residential inventory of 22,633 units, with a near even split between existing (10,819 units, 48%) and under construction (11,814 units, 52%) stock. This balance highlights the community’s established appeal alongside a strong pipeline that signals ongoing investor and end-user demand.

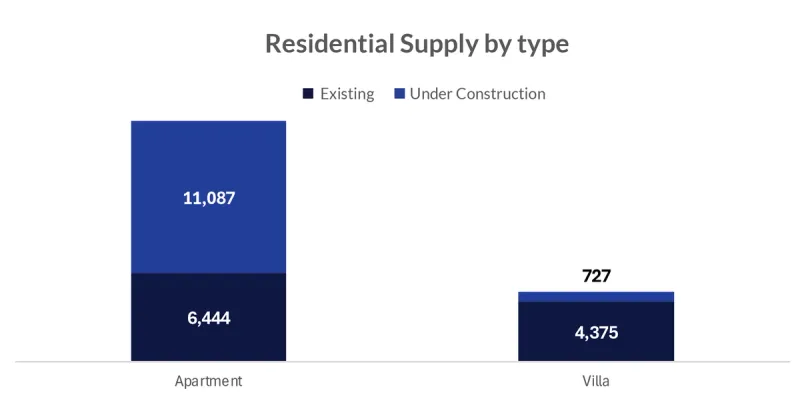

Apartments dominate the landscape: 6,444 of the existing units are apartments versus 4,375 villas. This ratio extends into the pipeline, with 11,087 apartments under construction compared to just 727 villas. The sharp tilt toward apartments suggests a deliberate move to introduce higher-density, investment-oriented products at more accessible price points.

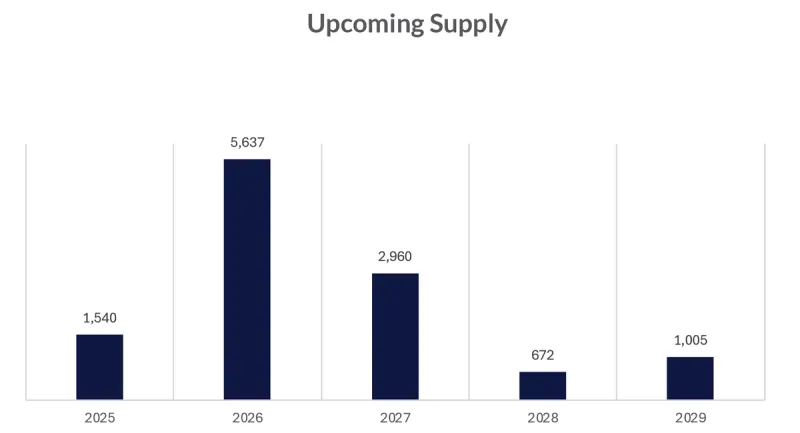

Looking ahead, supply is set to peak in 2026–2027 with 5,637 and 2,960 units, respectively. Only 1,540 units are due in 2025, offering a short-term window of constrained new supply. This delivery profile supports the strong capital and rental growth already observed across both villas and apartments since 2022, particularly in the ready segment.

Upcoming Supply

Given the limited upcoming villa supply, pricing pressure here is likely to remain minimal, especially for high-quality, end user stock. In contrast, the apartment segment may see more competitive dynamics post-2026 unless demand continues to absorb supply efficiently.

In short, while the pipeline is material, the staggered delivery offers headroom for further price and rent growth in the near term, particularly in premium, early delivery stock.

Dubai Hills Estate continues to cement its position as one of the most compelling destinations for residential property investment in Dubai. With exceptional masterplanning, strong price performance and consistently high demand, the community has delivered both capital appreciation and rental income growth across all property types. From 2022 to Q1 2025, secondary villa prices surged by 68% and apartments by 45%, while off-plan villas saw a 59% increase, highlighting sustained confidence across buyer segments.

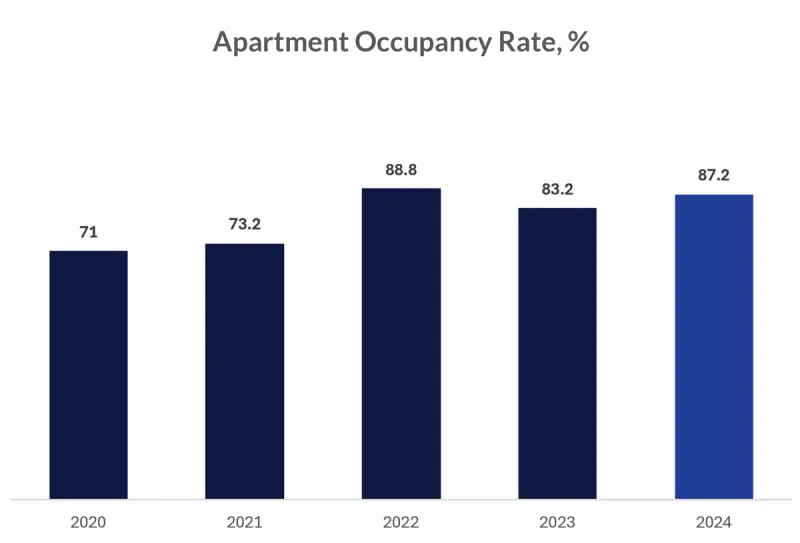

Dubai Hills rental trends have also shown robust growth, with villa and apartment rents rising 66% and 52% respectively during the same period. Despite this, rental yields have softened marginally due to a rising proportion of renewed contracts, reflecting tenant stability rather than weak leasing performance. Dubai Hills occupancy rate now exceeds 87%, up from 71% in 2020, underscoring how demand has outpaced supply in recent years.

While a pipeline of 11,800 units is under construction, supply is phased through to 2029, allowing continued price resilience in the near term. With premium positioning, strong infrastructure, and proximity to key hubs, Dubai Hills Estate remains an ideal choice for both long-term investors and end users seeking value, growth potential and lifestyle quality.

For further insights and comprehensive real estate advisory services, please contact Driven Properties at +971800374836