1 minute 30 seconds

Written by

Ishita Baid

Dubai Real Estate Insights & Trends in Nov 2025

Updated: Dec 03, 2025, 06:16 PM

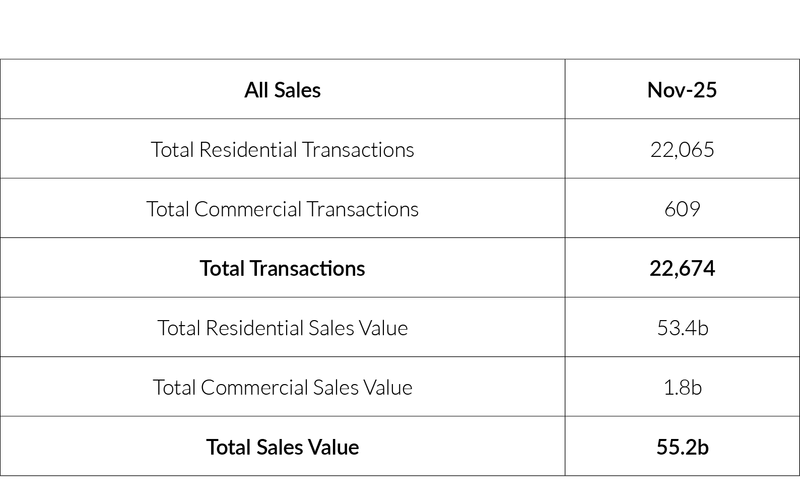

Market Activity Snapshot – Dubai Real Estate

Market Activity Snapshot – Dubai Real Estate Market Trends

Sustained residential dominance: With 22,065 residential transactions, the market continues to be driven overwhelmingly by end-user and investor demand for homes, signaling strong population growth and lifestyle-driven buying, according to Dubai property market reports.

Commercial sector stabilizing: Although Dubai real estate insights recorded only 609 transactions, the 1.8 b AED commercial value indicates higher average ticket sizes, suggesting selective but meaningful investment in income-producing assets and business expansion.

Robust capital inflows overall: Dubai property sales analysis shows a total sales value of 55.2 b AED, led by 53.4 b AED in residential sales, reflects continued confidence in Dubai as a safe, long-term investment hub amid global uncertainty.

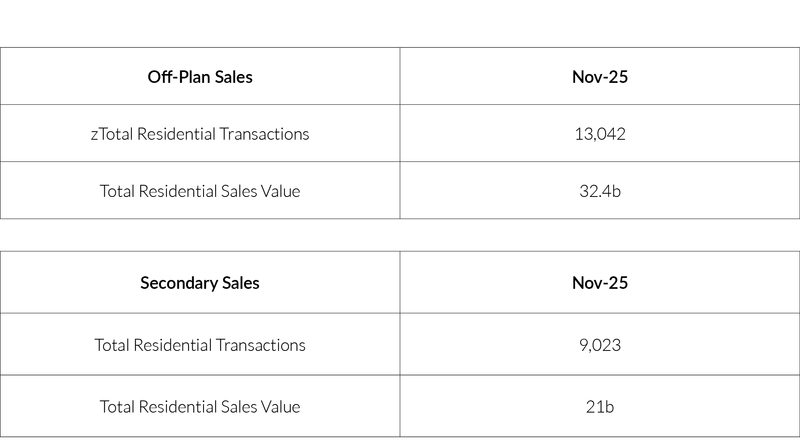

Off - Plan and Secondary Snapshot – Dubai Real Estate

Off-plan drives market momentum: With 13,042 transactions and 32.4 b AED in value, off-plan continues to command the larger share, reflecting strong investor confidence in future supply, developer credibility, and long-term growth expectations as per Dubai real estate statistics.

Dubai secondary market data remains resilient: The 9,023 secondary transactions generating 21 b AED highlight sustained end-user demand and liquidity in ready properties, demonstrating a healthy balance between new launches and existing stock.

Value gap shows premium on new supply: Dubai off-plan market trends show notably higher sales value which suggests buyers are willing to pay a premium for modern amenities, flexible payment plans, and emerging locations signaling continued evolution of buyer preferences toward future-ready communities.

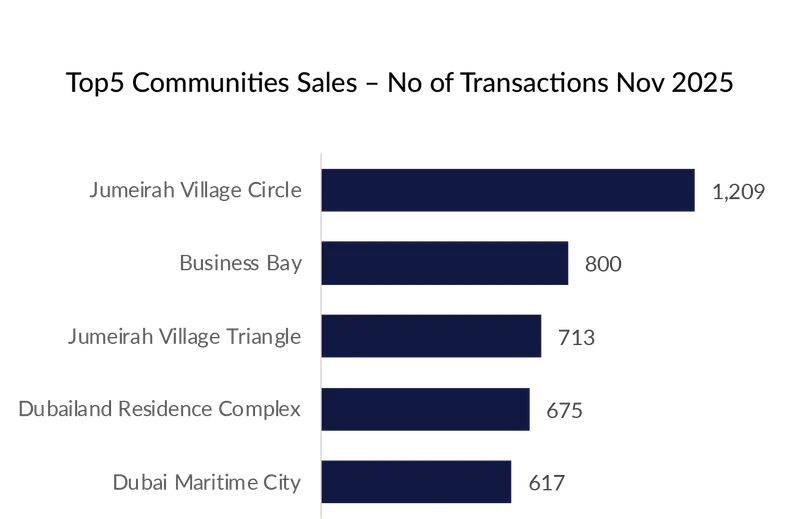

Community Highlights

Jumeirah Village Circle’s 1,209 transactions reinforce its position as Dubai’s liquidity anchor, with Business Bay and JVT closely following signaling continued demand for mid-market, well-located communities.

Jumeirah Bay Island’s 10,227 AED/sq.ft far outpaces all others, confirming that ultra-prime locations continue to command extreme premiums despite representing a small share of overall volumes.

In terms of Dubai community transactions, high-transaction mid-market areas and ultra-luxury coastal enclaves are moving in parallel, highlighting a market where investor-driven volume and wealth-driven exclusivity coexist without cannibalizing each other.

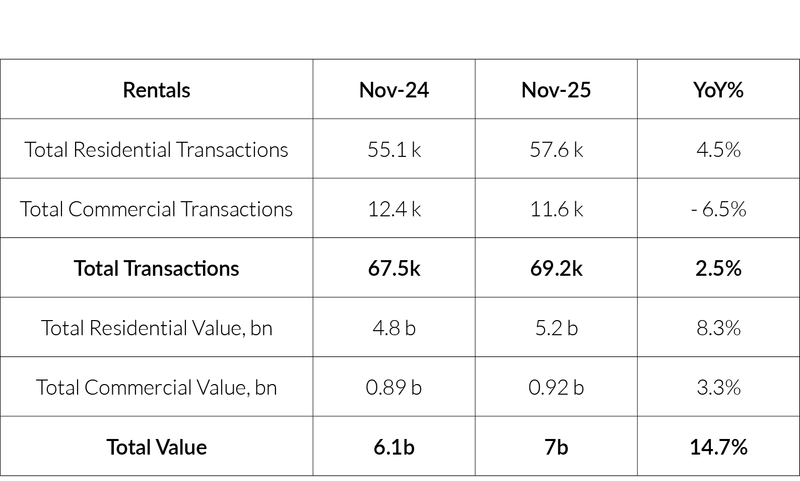

Rental Market Dynamics

Residential rentals continue to strengthen: Dubai rental market updates show a 4.5% rise in residential leasing transactions and an 8.3% increase in value, which reflect sustained tenant demand driven by population growth, relocation inflows, and affordability pressures in the sales market.

Commercial leasing softens but remains stable: Despite a 6.5% decline in commercial rental transactions, the segment’s 3.3% value growth suggests fewer but higher-value leases, indicating selective corporate expansion rather than broad-based demand.

Overall rental market expands meaningfully: With 69.2k total leases and a 14.7% surge in total rental value, the market shows healthy upward pressure on rents, underscoring strong economic activity and continued confidence across both residential and commercial segments.

For further insights and comprehensive real estate advisory services, please contact Driven | Forbes Global Properties at +971800374836.