2 minutes read

Written by

Ishita Baid

Dubai Set to Benefit from UK’s Changing Tax Regime and Global Relocation Wave

Updated: Nov 14, 2025, 05:46 PM

The UK’s proposed “exit tax” — a potential 20% levy on unrealized gains for individuals leaving the country — represents one of the most significant shifts in the nation’s tax landscape in recent years. This proposed measure aims to tax wealth before it leaves the UK, affecting shares, business ownership, and investments even where no sale has occurred.

Historically, the UK’s appeal to international investors and high-net-worth individuals (HNWIs) rested heavily on its advantageous non-domiciled (non-dom) tax regime. For over 200 years, non-dom residents could live in Britain while being taxed only on UK-sourced income, with foreign income taxable only if brought into the UK. This UK tax regime provided a powerful incentive for global wealth to base itself in London.

However, as of April 2025, this landscape has fundamentally changed. The abolishment of the non-dom regime and the end of the remittance basis mark a decisive shift in UK tax policy. Under the new residence-based system, all UK residents are taxed on worldwide income and gains as they arise. While the Foreign Income and Gains (FIG) regime offers a limited four-year exemption for new arrivals who have been non-resident for at least ten years, the long-term flexibility and planning advantages of the previous system have been lost.

This dual shift—the proposed UK exit tax and the end of the non-dom regime—has accelerated a broader trend: the relocation of global wealth. With increasing uncertainty, higher fiscal exposure, and diminishing planning tools in the UK, many investors are reassessing their options.

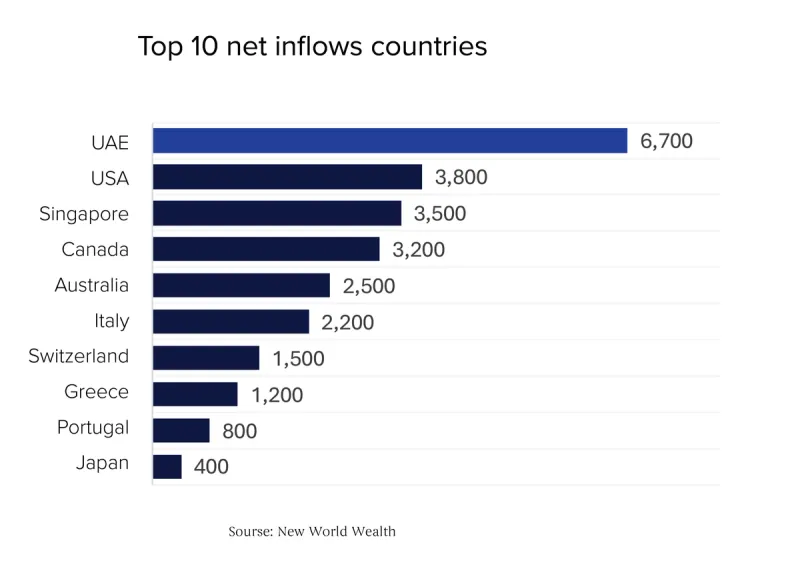

The global migration data shows many Ultra High Net Worth Individuals are relocating to Dubai. Wealth migration is no longer just a reaction to tax increases; it is a rational reassessment of risk, opportunity, and the value of remaining in an increasingly complex fiscal environment.

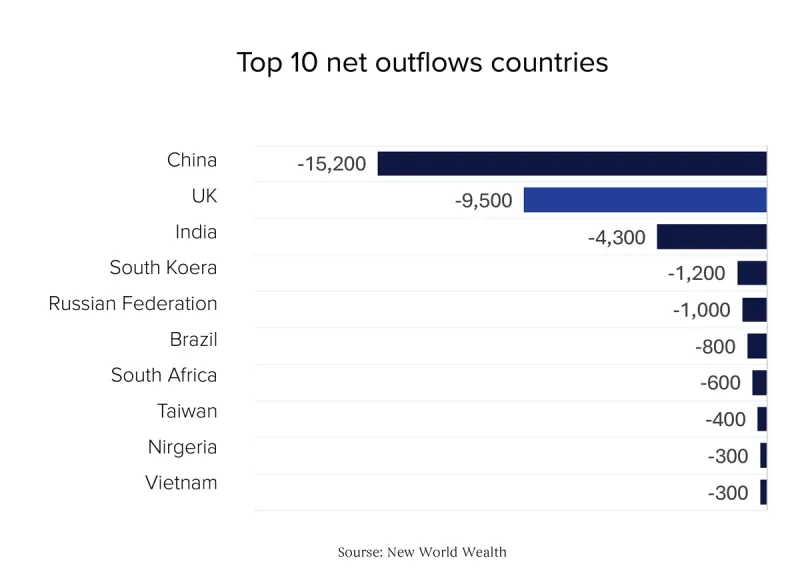

In 2024 alone, the UK experienced a net outflow of approximately 9,500 millionaires—the highest of any country worldwide, according to data from Henley & Partners. This trend is accelerating, with HNWIs increasingly relocating to jurisdictions such as the UAE, Singapore, and Switzerland in search of more favourable tax treatment, regulatory stability, and long- term wealth security.

As the global wealth landscape undergoes seismic change—particularly following the UK’s abolition of the non-domicile regime—see why investors are actively re-evaluating their options. Among the destinations gaining prominence, Dubai stands out as a premier jurisdiction for capital relocation, wealth preservation, and long-term planning.

Dubai has emerged as one of the strongest destinations for this new wave of relocation. With no personal income tax, no capital gains tax, no inheritance tax, and no tax on global income, it offers a level of financial efficiency and stability unmatched by many Western jurisdictions. Its real estate market, with freehold property options for foreigners and rental yields averaging 6–8%, presents both security and strong returns.

Dubai provides a uniquely transparent and advantageous tax regime. There are no personal income taxes, capital gains taxes, inheritance taxes, or annual property taxes. Individuals are not taxed on global income, and there are no wealth or dividend taxes. In contrast to the UK’s increasingly complex and politically sensitive tax landscape, Dubai offers true simplicity—free from remittance planning, mixed fund analysis, or statutory residence tests, fueling a UK to Dubai exodus.

Real estate lies at the heart of Dubai’s appeal as a global wealth anchor. For both international and UK-based investors, it offers a compelling combination of income yield, capital preservation, and estate planning advantages:

With average gross rental yields between 6–8%, Dubai property significantly outperforms prime London yields (2–4%). Capital appreciation is driven by sustained demand, a controlled premium supply pipeline, and robust population growth.

Moreover, Dubai is not blacklisted under major international tax treaties, ensuring continued access to global banking, investment services, and cross-border financial platforms—a critical factor for globally mobile families.

Dubai’s real estate sector also serves as a gateway to long-term residency:

The combination of political stability, clear regulations through the Dubai International Financial Centre (DIFC), and long-term residency options such as the Golden Visa further enhance Dubai’s appeal as a global wealth hub.

In contrast, the UK now faces a period of uncertainty as it transitions away from long-standing tax principles. For HNWIs and globally mobile families, the new environment may no longer support long-term wealth preservation in the way it once did.

Together, the exit tax proposal and the end of the non-dom regime mark a turning point. For many, they signal the end of the UK’s historical role as a premier wealth destination—and the rise of new centres such as Dubai, which offer predictability, neutrality, and strategic opportunity for long-term global wealth planning.

For further insights and comprehensive real estate advisory services, please contact Driven | Forbes Global Properties at +971800374836.